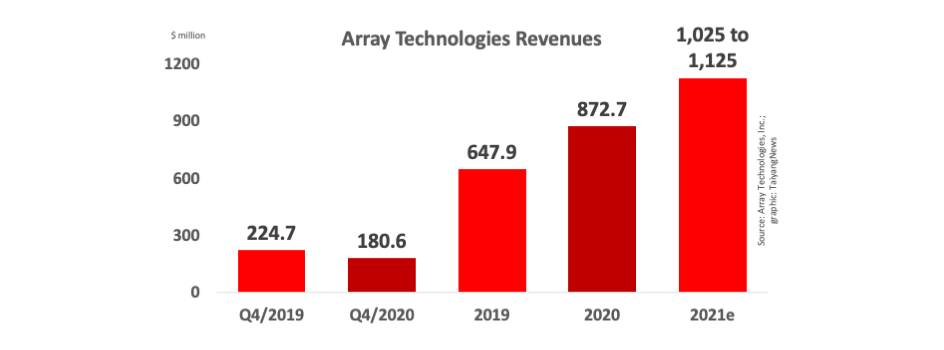

- Array Technologies reported 20% decline in annual revenues for Q4/2020, with net loss of $9.8 million

- In 2020, its annual revenues grew 35% to $872.7 million, reporting net income of $59.1 million

- Management is focused on gaining market share through international expansions and acquisitions, and US continuing to remain a key market

- Company has guided for annual revenues in 2021 to fall between $1.025 billion to $1.125 billion

Announcing the company’s 2nd quarterly financial results after it got listed on NASDAQ, US based solar tracker manufacturer Array Technologies, Inc. reported 20% YoY decline in its revenues that added up to a total of $180.6 million, along with $9.8 million net loss, compared to a net income of $26.8 million a year back.

Gross profit for the tracker maker for the utility scale segment declined 41% YoY to $60.6 million, as did its gross margin that dropped from 27% to 20%.

The management attributed this annual decline in Q4/2020 revenues to seasonal slowdown in business as, it explained, most customers prefer Q1 and Q2 to take deliveries in order to preserve 30% ITC rate for their projects.

On a full year basis, it fared better with annual revenues for 2020 reaching a total of $872.7 million, growing 35% from 2019, with net income of $59.1 million growing 49% over the same period. Adjusted EBITDA grew 32% to $160.5 million.

Having added 38 new customers in 2020, Array landed several big orders last year (see Array Technologies Lands Another GW Level Order).

Higher revenues during the year contributed to gross profit going up 35% to $202.8 million, its gross margin was flat ‘driven by reductions in the cost of purchased materials which offset higher logistics costs in the second half of the year caused by COVID-19 related freight increases’.

Referring to this, Philip Shen of Roth Capital Partners added, “Through our Q4’20 preview checks over recent months, many customers complained to us about high steel prices and freight. Our understanding was that ARRY could pass this through to customers, and, as a result, we mistakenly did not see this as a potential issue. ARRY still has pass through pricing power, but is choosing to use it judiciously. We believe management could take a conservative approach and not pass along all the cost increase to possibly share some of the pain with its customers. So the slightly worse than expected margin outlook reflects the need to support customers for the long game.”

Strategy

Array says it continues to focus on its 3 core growth strategies in 2021, namely continued market share gains in the US, international expansions, and acquisitions of companies that provide complementary products, services or technology. CEO Jim Fusaro said product innovation is also on Array’s mind as it aims to address common pain points in utility scale solar installation. Management revealed that recently Array invested in a technology company that it claims has the potential to significantly reduce the cost of installing trackers.

It has opened Array Tech Research Center in Arizona to research, develop and test advanced solar tracker technology which will act as a ‘proving ground’ where it says customers can explore product prototypes.

Guidance

For full year 2021, Array has guided for its revenues to fall in the range of $1.025 billion to $1.125 billion, with adjusted EBITDA of $164 million to $180 million.

At the end of December 2020, Array’s total executed contracts and awarded orders added up to $705.3 million, of which it expects to recognize $654.2 million in 2021.

“The two-year extension of the 26% investment tax credit (ITC) has significantly expanded the universe of viable projects in the U.S. which should lead to higher volumes as well as change how our customers time their orders,” pointed out Array Technologies CEO Nipul Patel. “The elimination of the ITC step-downs in 2021 and 2022 take away the incentive for customers to place their orders in Q4 and take delivery in the first half. As a result, we expect to see a more even distribution of our revenues throughout 2021 than we did in 2020, reflecting traditional construction seasonality with more of our revenue coming in the second and third quarters than the first and fourth quarters.”

Cowen’s Emily Riccio agreed, “While backlog is solid, profitability in ’21 will be pressured by rising steel costs, increased investments to expand international business, and accelerated investments in the new advanced technology center in Phoenix.”

TaiyangNews is set to launch our 1st Market Survey on Solar Trackers on April 13, 2021, for which we are hosting a virtual conference titled Solar Trackers—How to Follow The Sun Optimally To Maximize Yield Of Utility-Scale PV. Registrations are free here.