- ReneSola’s 2020 revenues declined 38% YoY along with 50% drop in gross profits

- Europe contributed most to the business, followed by North America and China

- During Q4/2020, its revenues increased 72% sequentially and it turned profitable on annual basis

- In 2021, it has guided for revenues to grow to between $90 million to $100 million while aiming for pipeline to grow to 2 GW

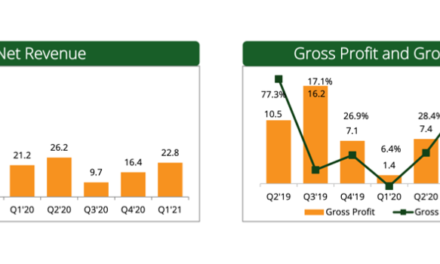

Chinese solar power company with US base, ReneSola Power exited 2020 with total revenues of $73.9 million declining 38% from last year and a 50% drop in GAAP gross profit of $17.2 million, with a gross margin of 23.2%, having dropped from 28.7% in 2019 (see ReneSola Grew Gross Profit In 2019 By 22%).

To the annual revenues, its project development business added the major share, $49.6 million, followed by $23.5 million from the independent power producer (IPP) business mainly from electricity sales in China, and another $0.8 million from operations and maintenance works. Most of the business came from Europe that accounted for 50.1% of total revenues in 2020, followed by 27.5% by North America, and 22.4% from China. It is aligned with the management’s focus on high profitable markets of Europe and the US (see ReneSola Shifting To US Under New Management).

Management blamed timing of project sales for the revenue being down in 2020.

Adjusted EBITDA for the year 2020 too went down for the company by 50% during the year, according to the financial results published by the company. It sold 86 MW of solar projects last year.

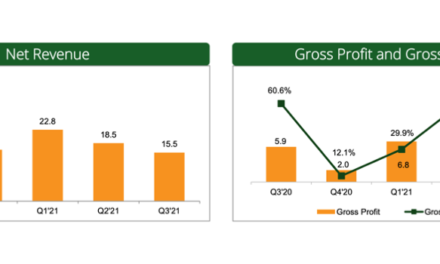

During Q4/2020, it managed to report 72% sequential growth in revenues of $16.8 million, however the GAAP gross profit declined 58% to $2.5 million, and adjusted EBITDA dropped 66% to $2.1 million. However, the company turned profitable in the quarter reporting net income of $2.5 million, compared to $-10.9 million net loss in Q4/2019.

Guidance

Going forward, the company is more hopeful of its business doing well forecasting Q1/2021 revenues of $18 million to $20 million with a gross margin of 10% to 11%. For full year 2021, its revenues are guided within the range of $90 million to $100 million with gross margin of up to 25%.

However, the management pointed at the uncertainty in the global markets related to COVID-19’s continued impact which can lead to some slowdown in activity in some geographic regions in H1/2021. Adding ‘normal fluctuations typical of the project development pipeline’, the company has ‘factored variability’ in its outlook. Going forward, it plans to focus on the solar markets of Europe, US and China.

At the end of 2020, ReneSola’s late stage solar power project pipeline stood at 1 GW in Europe and the US, growing from 730 MW at the end of Q3/2020. By the end of 2021, it now targets to build a 2 GW pipeline in core markets of US and Europe, and sell close to 300 MW projects.