- CER report on carbon markets in Australia claims 6.3 GW of new renewable energy capacity was installed in the country in 2019

- This came from 2.4 GW of rooftop solar PV and 3.9 GW of utility scale capacity

- In 2020, CER expects another 6 GW to 6.5 GW of new renewable energy capacity to be delivered

- Last year, 1 GW of total renewable energy capacity was accredited with 1.3 GW in Q4/2019 alone

- Investment commitments of some 5.3 GW capacity is in delivery pipeline, according to the report, and will be delivered as actual investment in 2020 and beyond

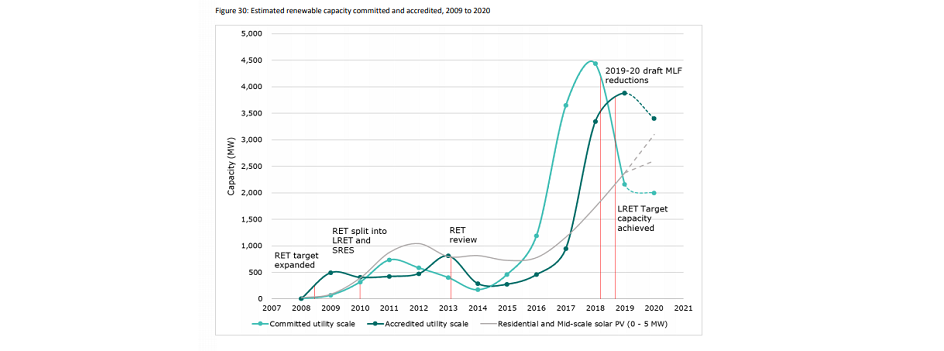

By the end of 2019, Australia had 25% of electricity in the National Electricity Market (NEM) coming from renewables after adding 6.3 GW last year, according to the country’s Clean Energy Regulator (CER). This is 24% more than what was reported for 2018, and which according to the government agency shows the Renewable Energy Target (RET) ‘has not acted as a cap on renewable investment’.

Under the RET, Australia aims for 33,000 GWh of renewable energy generation in 2020, but the official government body believes this target will be overachieved with anywhere between 35,000 GWh to 37,000 GWh of renewable energy being generated in 2020, despite grid connection issues and curtailment challenges (see Australia To Exceed LRET Target In 2020: CER).

In its report Quarterly Carbon Market Report—December Quarter 2019, CER says total electricity generated or displaced by RET incentivized renewable power generation should increase from 44 TWh to 56 TWh in 2020.

Of the 6.3 GW, the CER report shows residential and commercial rooftop solar PV capacity installation increased by 40% from 1.7 GW in 2018 to 2.4 GW in 2019. Utility scale renewable capacity increased from 3.3 GW in 2018 to 3.9 GW in 2019.

A January 2020 commentary from Sunwiz claimed 2.13 GW of new rooftop solar power was installed in Australia last year, which meant 35% YoY growth (see Australian Rooftop Solar Market Grew 35% In 2019).

For 2020, CER expects another 6 GW to 6.5 GW of new renewable energy capacity to be delivered. The report writers argue, “The Clean Energy Regulator believes a second wave of renewables investment can be unlocked if the necessary grid work can be progressed quickly, and changes are made at a distribution level to enable high levels of annual rooftop solar capacity additions to continue.”

During Q4/2019, Australia accredited 122 new power stations comprising solar and wind power technologies with an aggregate capacity of 1.3 GW with New South Wales leading, adding to the overall accredited capacity in 2019 at 4.1 GW, growing 14% annually. (Source: Clean Energy Regulator)

In 2019, 4.1 GW of total renewable energy capacity was accredited, 14% more than in the previous year with 122 new power stations making the cut with 1.3 GW aggregate capacity in Q4/2019. The latter includes three large solar farms in New South Wales (NSW) accounting for a significant proportion of the accredited capacity, namely 333 MW Darlington Point Solar Farm, 255 MW Sunraysia Solar Farm and 306 MW Limondale Sun Farm 1.

It made a bid to allay fears about investment in renewables suffering after the RET cap is reached and no federal future course of action beyond the RET, CER claims investment commitments of some 5.3 GW capacity remains in the delivery pipeline and will be delivered as actual investment in 2020 and beyond. New projects accredited between 2020 and 2030 are still eligible to receive large scale generation certificates (LGC) that can be used to meet legislated or voluntary demand.

The quarterly report from CER outlines the supply and demand trends and opportunities in the national carbon markets that it administers with a view to reduce the country’s carbon emissions. It reports that carbon abatement from its administered schemes reached 50 million tons of CO2 equivalent or CO2-e in 2019 and is expected to ramp up to 59 million tons CO2-e in 2020.