- NTPC has adjudged three winners in the recently launched 750 MW PV tender for the Ananthapuramu Ultra Mega Solar Park in Andhra Pradesh

- Sprng Energy won 250 MW with lowest winning tariff of 2.72 INR ($0.0403) per kWh, according to Mercom India Research

- Two other winners with 2.73 INR ($0.0405) per kWh tariff are Ayana Renewable Power and SBG Cleantech

Three winners have emerged in the recently launched tender for 750 MW PV capacity in Andhra Pradesh’s Ananthapuramu Ultra Mega Solar Park. The National Thermal Power Corporation of India (NTPC) divided the entire capacity into three projects of 250 MW each. It had launched the tender in March 2018 (see NTPC Launches PV Tenders For 2.75 GW).

The lowest winning tariff was 2.72 INR ($0.0403) per kWh and was offered by Sprng Energy, which is backed by London based private equity fund manager Actis. The other two winners are UK development finance institution CDC Group plc backed Ayana Renewable Power and SoftBank promoted SBG Cleantech. Both the companies won 250 MW capacity each for 2.73 INR ($0.0405) per kWh, according to Mercom India Research.

SB Energy bid for the entire 750 MW, but managed to secure only 250 MW.

The three winners succeeded over big names in the auction, like ACME Solar, Tata Power, Fortum, ReNew Power, Hero Future Energies, Azure Power. These companies offered bids in the range of 2.74 INR to 3.28 INR ($0.0406 to 0.0486) per kWh.

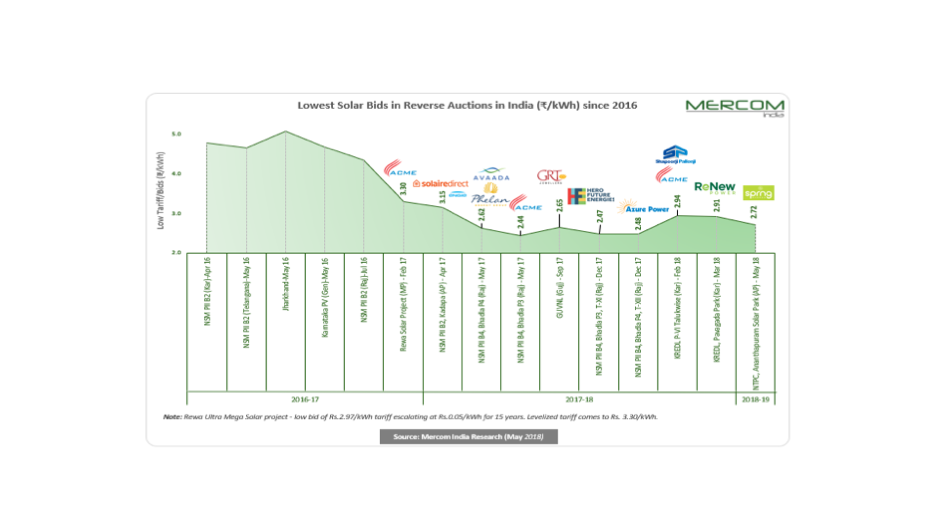

The record lowest winning bid in Indian solar power auctions is as low as 2.44 INR ($0.037), which was offered by ACME Solar for the Bhadla Phase III Solar Park (see ACME Wins 200 MW At 2.44 INR Record). The last big auction results saw 2.91 INR ($0.0447) as the lowest winning tariff in the 1.2 GW tender by Karnataka Renewable Energy Development Limited (KREDL) in March 2018 (see KREDL Auctions 550 MW). In April 2018, Gujarat Urja Vikas Nigam Ltd. (GUVNL) cancelled its 500 MW PV auction for the lowest winning bid being too high at 2.98 INR ($0.0456) (see 500 MW PV Auction Scrapped In Gujarat).

“The upward trajectory of the winning bids is evident with the auction results reflecting higher module prices, even with NTPC as the off-taker. Winning bids are up 12%since May of last year and this auction gives a taste of things to come if a safeguard duty is imposed in the future,” said Raj Prabhu, CEO of Mercom Capital Group.This, he added, should serve as a warning to the policy makers that uncertainty is expensive.