It’s not that very large solar modules are really new in the solar sector. Already in the 1980s, Arco Solar was designing large modules, consisting of several sub-modules combined and held by back rails for PV power plants. In 2005, Solon introduced its Solon-Mover, an over 9 kW dual-axis tracking solution with 1,000 W modules integrating high-efficient SunPower cells. And a little later, in 2007, Applied Materials presented a 5.7 m2 SunFab amorphous silicon thin-film module, measuring 2.6 x 2.2 m.

None of these large-scale module products is available anymore. While they were commercialized at the time, they usually quickly vanished for various reasons. However, ‘déjà vu’ moments are common in solar. Invented, tested and tried at some point, it usually takes many years until a promising technology takes over the industry. A good recent example is PERC, the latest standard cell technology that was invented in the 1980s, but took until 2017/18 to succeed in the mass market as it needed the right production equipment capable for low-cost mass production and the right moment – another technology (BSF cells) that had no further development potential and a new investment cycle.

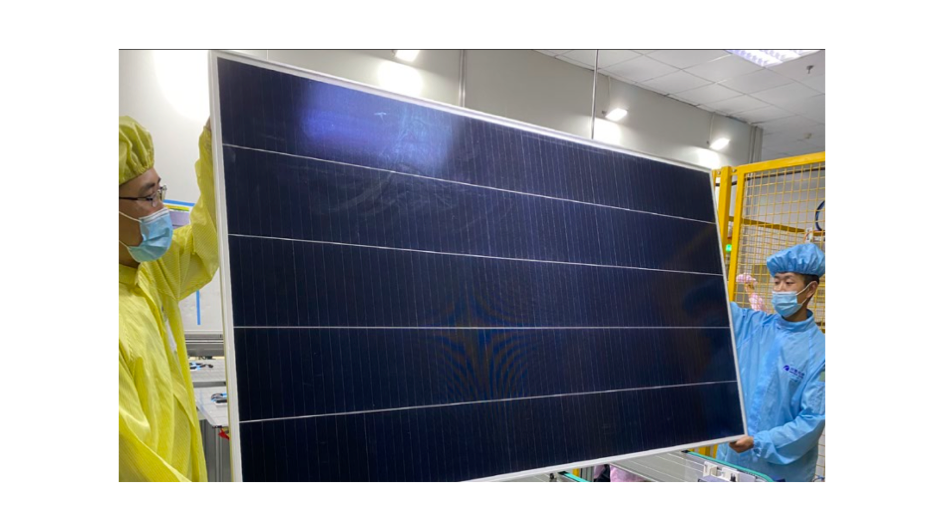

The 500 W+ modules and their successors are here to stay. We have been seeing a constant evolution towards higher power ratings for standard modules used in utility- scale solar power plants. But an accelerated phase started only in 2019, when several advanced module technologies became available – such as half-cells, multi busbars, higher-density interconnection designs, larger wafers – and had been increasingly implemented together for new module products. The 400 W module level was reached in late 2018, the 500 W level in late 2019, and the 600 W level in mid-2020.

The recent boost in power ratings is also driven by a new competition phase among Chinese solar companies fighting for global leadership in the sector. As former leading mono wafer supplier LONGi has not only become the world’s largest wafer supplier, but also transforming into a vertically integrated company, now striving to develop into the world’s largest module company by year end with 30 GW, several of the top module companies have been increasing their internal wafer capacities to keep their independency, while quickly upping their module capacities as well.

The very fast race towards new and larger wafer formats must be seen as part of the gambit towards higher power module output. However, the underlying driver is obviously cost reduction. All solar manufacturers have to continue on this path to stay competitive and expand their businesses.

Does that mean we will see even larger wafers than 210 mm or even larger module dimensions? Probably. As long as any new developments support further cost reduction – and logistics, balance of system as well as installers can cope with it, this will happen.

The new 500 W+ products come with very high module efficiencies of at least 21%, although they are all based on standard PERC cell technology. With PERC cells about to reach its practical efficiency limits and little further roomto improve on today’s advanced module technologies, solar companies will soon have to finally opt for any of the next generation high-efficiency cell technologies. In other words, the next step towards higher module power ratings will stem from solar cells, which means rather capex intensive investments to enable these improvements when compared to the recent advanced module technology implementations (cell/panel producer Jolywood will present an up to 615 W n-type TopCon solar module during SNEC, which is not listed in this report).

The fast pace of recent module developments has caused some commotion on the balance of system side. Tracker and racking manufacturers have to adapt their product to larger module dimensions, inverter manufacturer have to solve the challenge of high currents from these new modules. Other stakeholders involved along the value chain have been facing challenges as well. For that reason, it is very good that both the 182 and 210 mm based module fractions have created platforms to “standardize” these products groups and work with all parties involved. While that won’t stop companies from innovating (there are apparently first attempts to look beyond 210 mm wafers), such platforms could turn into important facilitators for smoother transitions to new powerful module products.

Indeed, the next more powerful modules are already on the horizon. At TaiyangNews’ 500 W+ Solar Module Conference at the end of July 2020, Risen Energy presented its technology roadmap towards 700 W modules in 2023, and at the event’s executive panel, JinkoSolar VP Dany Qian said she expects modules to reach even 800 W or more in the future.

PS: Thanks a lot to Charlie Gay for his keynote at the TaiyangNews 500W+ conference, providing an overview with everything you need to know to understand the evolution of solar modules to 500W and beyond!

This is the conclusions part from the TaiyangNews 500W+ Solar Modules Report, which is for download free of charge here. If you visit SNEC in Shanghai from Aug. 8-10, you can pick a copy of the report at the registration in the conference center.