Improving light management and reducing resistance losses are the two main paths to improve module performance.

While improving light management primarily involves changing the BOM, antireflection coated glass is already a standard. The increasing interest in white EVA is a clear sign of efforts in this direction. White EVA is used as the bottom encapsulation layer, which in a finished module increases the light reflection from the cell gaps, resulting in power gains of up to 5 W. White EVA’s market share increased to 15% in 2019 from a nearly negligible base in previous years, as shown in our TaiyangNews Market Survey on Backsheet and Encapsulation Materials 2020.

Using reflective ribbons is yet another approach for enhanced light management. While light capturing ribbons are known for several years, LONGi Solar employing triangular shaped ribbon is a recent example of commercial activity in this area.

Reducing electrical losses mainly involves changes to the interconnection process. A first step in this direction was to increase the number of busbars. The PV industry has quickly adapted to 5-busbars, which is the standard for most of the leading companies today. However, would the trend continue towards 6 busbars is a question that is yet unanswered. While academia still sees the benefit of moving to 6-busbars, there is hardly any commercial activity in this area. Hanwha Q Cells was probably the first and also pretty much the only module maker offering products based on 6-busbars. In contrast, taking a big leap to MBB using several thin wires is gaining much preference among module makers.

ITRPV’s 11th edition expects the 3 and 4-busbar layouts, with about 5% market presence in 2020, to become obsolete by 2022 (see graph above). The 5-BB modules, today’s mainstream products, are also expected to lose their dominance slowly but steadily from about 65% market share in 2020 to about 10% in a decade. ITRPV is optimistic about the 6+ busbar configuration, estimating a consistently increasing share from about 20% in 2020 to a peak presence of about 55% in 2030. The 11th edition of the roadmap has clubbed all other advanced interconnection methods such as advanced MBB (busbar-less variant) and shingled in the “BB less” category and has voiced a positive outlook. These methods, with about 10% share in 2020, are expected to capture about one-third of the market in 10 years’ time.

In parallel to moving to a higher number of busbars, the industry has been working on several other advanced module technologies, such as half cells, glass-glass, bifacial and zero gap technologies including shingling, and has successfully commercialized them. Of late, however, employing larger wafers in pursuit of higher module powers has been the fully dominating talk of town.

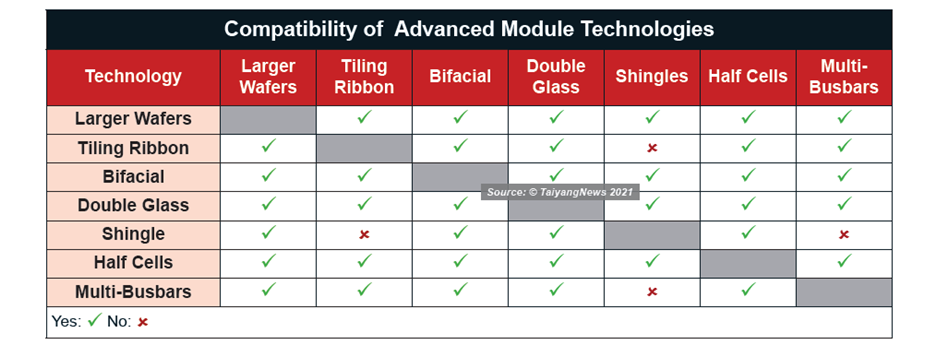

An important attribute of these advanced module technologies is most of them are inter-compatible to each other and can be applied collectively, which means that several combinations of these technologies can be applied in one module and the benefits get added up. Bifacial seems to be at the center of these combinations. Bifacial glass-glass technologies are combined with three other combinations.

The text is an excerpt from the TaiyangNews report on Advanced Module Technologies 2021, which is accessible for free here.

TaiyangNews Advanced Module Conference 2021 Videos are available on YouTube; to view the event recordings click here.

Advancing Solar Modules

While Every Advanced Module Technology Has A Specific Advantage, They Are Highly Inter-Compatible Enabling To Blend Several Technologies In One Module Product

The majority of advanced module technologies we have discussed are highly inter-compatible, thus can be applied collectively to sum up the individual benefits. (Source: ITRPV; graphic: © TaiyangNews 2021)