- JinkoSolar’s revenues suffered the negative impact of raw material shortage pushing up module prices in Q1/2021, among other factors

- It believes the impact is short term on downstream customers and that demand should return in H2/2021

- Management has lowered total production capacity expansion target for mono wafer, cell and modules to 30 GW, 24 GW, and 33 GW, respectively

- It has forecast Q2/2021 shipments to be within the range of 5.1 GW to 5.3 GW, and between 25 GW to 30 GW for 2021

- Company claims to have completed construction of a high-efficiency laminated perovskite cell technology platform

Integrated solar PV manufacturer from China JinkoSolar Holding felt the impact of tight supply of polysilicon on its business in Q1/2021 as its module shipments declined, partially offset by an increase in the ASP of modules. However, management sees the stress on module prices as temporary phenomenon.

“During the first quarter, the imbalance between polysilicon supply and strong downstream demand as well as many other factors continued to increase module prices on top of many factors, but we believe this the impact on downstream customers is temporary,” explained JinkoSolar’s Chairman of Board of Directors and CEO Xiande Li. “The lower demand has kept the prices from rising; as the prices of polysilicon stabilize, downstream demand is expected to resume in the second half of the year, with the present polysilicon supply chain sufficient to support 160GW of installations this year and 210GW of installations in 2022.”

Production capacity

Nonetheless, JinkoSolar is playing it safe and has adjusted its capacity expansion plan for 2021-end, lowering it to 30 GW for monocrystalline silicon wafers, 24 GW for high efficiency solar cells (including 940 MW N-type cells), and 33 GW for high efficiency modules, bringing it down from guidance it offered in the previous quarter for 33 GW, 27 GW and 37 GW, respectively (see JinkoSolar Shipped 18.8 GW Solar Modules In 2020). At the end of 2020, its production capacity of mono wafers, cells and modules was 22 GW, 11 GW and 31 GW in that order.

JinkoSolar has also made a strategic investment in polysilicon supplier Xinte Energy to secure its supply for its future shipment growth prospects (see JA & Jinko To Invest In Xinte Subsidiary). Another important investment by the company is an agreement with China COSCO Shipping Corporation to ensure transportation ease.

Q1/2021

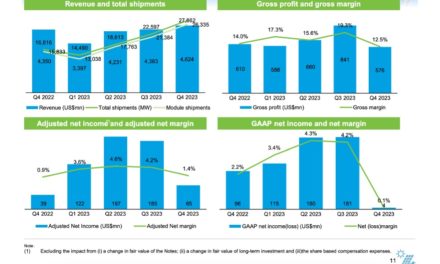

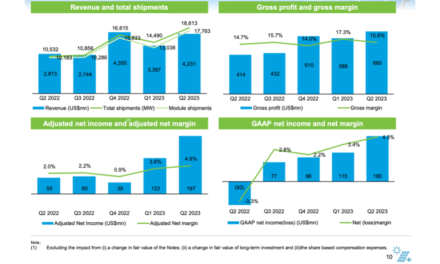

During the reporting quarter, its revenues were a total of RMB 7.94 ($1.21 billion) declining 6.4% over previous year, and 15.7% compared to Q4/2020. It does mention that on annual basis it would have been an increase of 9% if impact from disposal of 2 Mexican solar projects in Q1/2020 is factored in.

As a results, its gross profit of RMB 1.36 billion ($207.3 million) declined 18% YoY, while gross margin was reported at 17.1%, compared to 19.5% a year back (see JinkoSolar: COVID-19 Delayed Q1/2020 Shipments).

Nonetheless, its total shipments of 5,354 MW, comprised 4,562 MW for modules and 792 MW for cells and wafers, representing 33.7% improvement in module shipments.

“In the first quarter of 2021, our strategy was to carefully manage our supply chain as volatility continued to increase prices of raw materials quarter-over-quarter. As macroeconomic conditions continued to raise commodity prices, we remained flexible and focused on manufacturing process improvements to ease pressure on costs,” added Li.

He also pointed at ‘first-mover advantages’ and ‘relatively stable economic benefits’ for integrated production companies as itself with advanced technologies, despite rising material costs.

JinkoSolar is also expanding its production capabilities to perovskite domain announcing that it has completed the construction of a high-efficiency laminated perovskite cell technology platform and expects it to reach a ‘breakthrough cell conversion efficiency of over 30% within the year’.

Guidance

In Q2/2021, JinkoSolar has guided for its total shipments to be within the range of 5.1 GW to 5.3 GW, comprising 4.0 GW to 4.2 GW of solar modules, with revenues in the range of $1.2 billion to $1.25 billion and gross margin of 12% to 15%. For 2021, it expects total shipments to be between 25 GW to 30 GW.

TaiyangNews has covered JinkoSolar’s top module products in its recent Very High Power Solar Modules Report, which can be downloaded for free here.