- SunPower added 17,000 new customers in Q4/2021 taking its cumulative customer tally to 427,000

- It’s GAAP revenues during the quarter totaled $384.5 million with net income of $20.2 million

- For 2021, revenues added up to $1.32 billion revenues and net income loss of $-37.4 million

- Its deal with Maxeon Solar will now have exclusivity factor for a limited time period as it has decided to exit the CVAR business

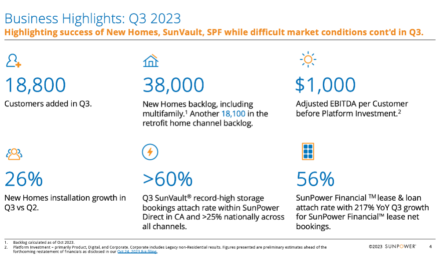

Residential solar power company in the US, SunPower Corporation increased its new customer bookings in Q4/2021 by 42% with 22,500 new bookings, adding 17,000 new customers—a number that increased 31% YoY taking its cumulative customer tally to 427,000 at the end of 2021.

To further focus on becoming a pure residential solar power company, SunPower has decided to exit its Light Commercial Value-Added Reseller (CVAR) business. Due to this, it has also entered into a new agreement with its spin-off Maxeon Solar Technologies, replacing the previous one which makes the exclusive supply of latter’s Interdigitated Back Contact (IBC) solar panels to SunPower for residential segment limited in nature (see New Supply Agreement For Maxeon & SunPower).

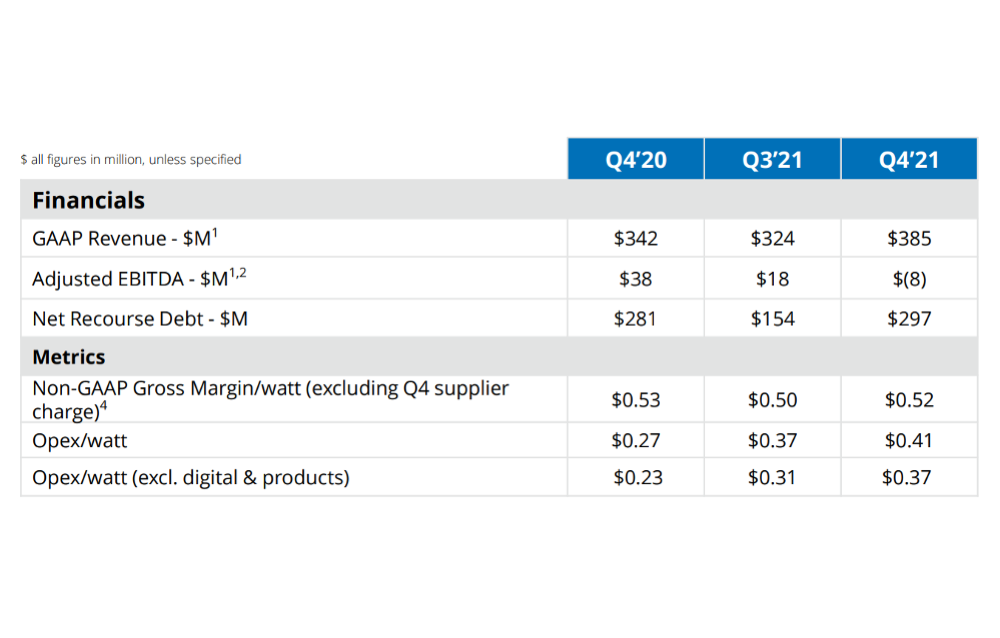

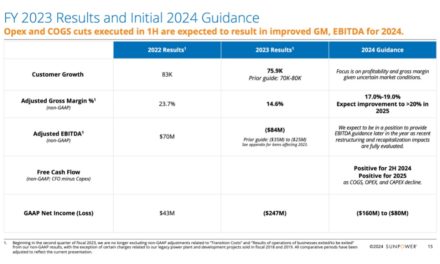

These factors will have their impact on the company’s adjusted EBITDA for 2022 that’s guided to fall between $90 million and $110 million, after reporting $76 million for 2021. It added though that 2022 adjusted EBITDA guidance excludes the outcome of California’s NEM 3.0 directive and potential changes to the Investment Tax Credit (ITC).

During Q4/2021, SunPower’s new homes customer pipeline including multi-family grew to 260 MW and its residential customer adjusted EBITDA reported as $2,200 per residential customer. “New homes segment showed accelerated growth with 8,700 new customers in the quarter, a 50% increase from the previous year, entering 2022 with a potential homebuilder pipeline of a record-high 66,000 customers,” stated SunPower.

For the reporting quarter, its revenues were $384.5 million, having grown from $341.8 million YoY, and net income of $20.2 million.

Earlier the company had provided its preliminary forecast for Q4/2021 expected adjusted EBITDA to be on the lower end of guidance citing California weather and COVID-19 related impacts (see SunPower’s Preliminary Q4/2021 Financials).

During 2021, SunPower registered $1.32 billion revenues compared to $1.12 billion, with gross margin of 16.7% over 14.9%. Its net income loss was $-37.4 million.

Management admitted to installation delays due to Omicron and weather-related challenges, as well as cost and availability pressure on its supply chain along with labor pool. Calling these short-term challenges, CEO Peter Faricy said the company remains optimistic of future growth.

SunPower’s forecast for 2022 is to grow its residential customer base by 35% annually to 73,000 to 80,000. Its residential adjusted EBITDA per customer is guided to range between $2,000 to $2,400.