Canada headquartered Canadian Solar Inc., sailed through Q2/2021 with an annual revenue growth of 105% with $1.43 billion and gross margin exceeding guidance to settle at 12.9%. The integrated PV module maker and project developer claims to have a global solar project pipeline of 22 GW out of which around 6 GW is contracted and/or under construction, while its global battery storage project pipeline now stands at 19 GWh of which 2.3 GWh is contracted and/or under construction.

Management admitted higher polysilicon and transportation cost environment, and said it is dealing with the same by raising module pricing while maximizing capacity utilization and also signing higher priced power purchase agreements (PPA) which the Corporate VP and President of Canadian Solar's Global Energy subsidiary Ismael Guerrero said it helping the company offset the impact of higher equipment costs.

"While we anticipate and respond to short-term market fluctuations, our long-term growth strategy remains unchanged. That is, to grow market share through capacity expansion, improve pricing power through technology differentiation and optimized channel structure, and gain more control over our supply chain through upstream positioning," added CSI Solar subsidiary's President Yan Zhuang.

Q2/2021

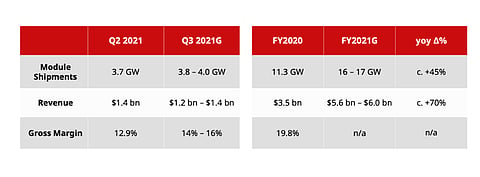

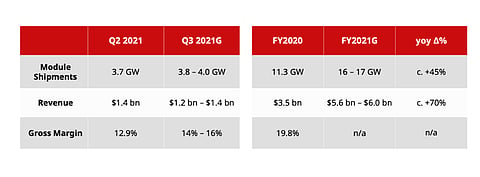

During Q2/2021, Canadian Solar shipped 3.66 GW, growing 26% YoY and 17% QoQ with 167 MW shipped to its own utility scale solar power projects. China was its top market by shipment volume during the quarter. Higher value distributed generation segment accounted for over 50% of its shipments.

Net revenues for the company grew by 105% YoY and 31% QoQ to $1.43 billion, thanks to higher module shipments and ASP, growth in beyond-module sales and higher revenue contribution from battery storage shipments, partially offset by lower project sales.

Gross profit grew 26% YoY but dropped 5% QoQ to $185 million, and gross margin was registered at 12.9%. Its total debt in the reporting quarter was $2.23 billion, coming slightly down from $2.28 billion in Q1/2021.

Manufacturing

The company has a little altered its manufacturing capacity expansion plans for the end of 2021 to 5.1 GW for ingots, 11.5 GW for wafers, 13.9 GW for cells and 22.7 GW for modules (see Canadian Solar Grew Q1/2021 Revenues By 32% YoY). It would be a growth from 5.1 GW, 8.7 GW, 13.3 GW and 19.7 GW respectively at the end of H1/2021.

Its N-type heterojunction (HJT) solar module is on track to be available commercially from Q4/2021 having reached 24.7% cell efficiency, it said.

Guidance

During Q3/2021, Canadian Solar expects to ship 3.8 GW to 4.0 GW solar modules with revenues ranging between $1.2 billion to $1.4 billion, and gross margin of 14% to 16%.

In FY2021, it has lowered the annual guidance for module shipments to be between 16 GW to 17 GW, compared to previous guidance of 18 GW to 20 GW growing over 45% annually. However, annual revenue guidance is unchanged at $5.6 billion to $6.0 billion, growing over 70% YoY. Project sales guidance remains within the range of 1.8 GW to 2. 3 GW and total battery storage shipment guidance of 810 MWh to 860 MWh.

According to Philip Shen of Roth Capital Partners, lower shipment guidance for 2021 is a result of the company quoting higher module prices leading to fewer new orders, and some orders getting pushed into 2022. Shipping delays causing some deliveries to arrive later than anticipated.

By the year 2025, Canadian solar aims to grow its project sales volume by a compound annual growth rate (CAGR) of 25%, reach a minimum of 1 GW of combined net ownership of solar power projects through these vehicles, and reach 11 GW of projects under O&M agreements by 2025.

All said and done, Shen believes the Withhold Release Order (WRO) of the US government, if there is one against Canadian Solar, could be a key risk to watch ahead.