- Daqo New Energy’s polysilicon production and supply improved significantly in Q4/2020 and 2020

- Management continues to see tight supply of polysilicon in 2021, which is likely to push up prices that it believes have already reached a range of $15 per kg to $16 per kg

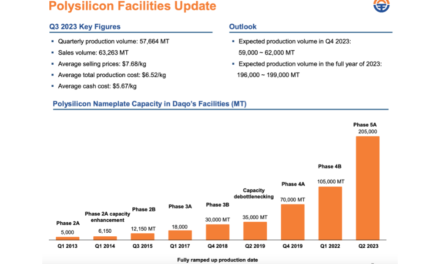

- Company to expand production at Xinjiang under phase 4B with 35,000 MT, and can consider further expanding capacity

- The amount of capacity expansion would depend on the proceeds its subsidiary is able to raise through the planned STAR Market IPO

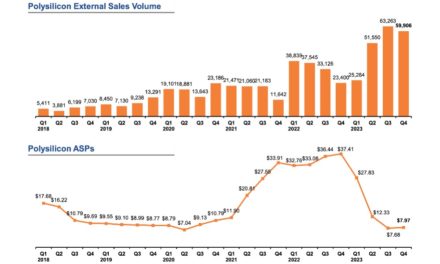

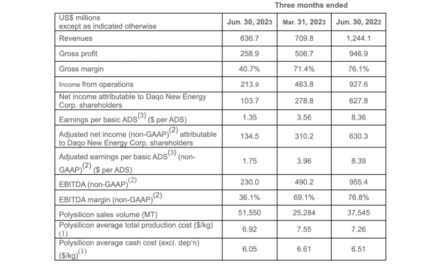

Chinese solar grade polysilicon producer Daqo New Energy reported a strong Q4/2020 selling 23,186 MT polysilicon as guided, growing from 13,291 MT a year back, while its production volume grew as well to 21,008 MT compared to 16,204 MT in Q4/2019 (see Daqo Releases 2020 Revenue & Net Profit Guidance).

What helped Daqo in Q4/2020 is a high ASP of $10.79 per kg, having increased from $9.13 per kg sequentially, thanks to tight supply of polysilicon in the global markets, taking total quarterly revenues to $247.7 million. Management continues to see polysilicon price rise that it says has now reached a range of $15 per kg to $16 per kg.

Daqo’s net income in the reporting quarter went up to $72.8 million, compared with $20.1 million in Q4/2019, and its gross margin was 44.2%.

On full year 2020 basis, Daqo’s polysilicion production volume was 77,288 MT, up from 41,556 MT it produced in 2019, while selling 74,812 MT earning annual revenues of $675.6 million, compared to $350 million in the previous year. Its gross profit was a whopping $234 million, rising from $80.1 million on YoY basis. The polysilicon manufacturer’s net income was $129.2 million, compared to $29.5 million in 2019.

“As our mono-wafer customers continue their capacity expansion plans supported by robust downstream market demand, we believe that the supply of polysilicon will continue to be very tight throughout the year given very limited additional polysilicon supply this year,” said Daqo New Energy CEO Longgen Zhang.

Production expansion

Daqo said it is planning to add 35,000 MT production capacity as phase 4B at its Xinjiang facility, which is likely to enter construction in mid-March 2021, complete by end of 2021, and ramped up to full capacity by the end of Q1/2022. To fund the design and procurement process of this phase, the company will use proceeds from the planned initial public offering (IPO) of its subsidiary Xinjiang Daqo on Chinese STAR Market. The subsidiary is now expected to complete its registration process with the China Securities Regulatory Commission.

In 2021, Daqo expects to produce 80,000 MT to 81,000 MT polysilicon and in 2022 targets to grow almost 50% to 120,000 MT, stated the management in a call with analysts and said that future expansion plans may include adding 40,000 MT, 80,000 MT or even 100,000 MT capacity, but it very well may be outside of Xinjiang. However, these plans hinge on how much the IPO helps it raise. Management expects it to raise RMB 5 billion or more when the listing is closed in April 2021 or May 2021.

Roth Capital Partners believes Daqo is almost 100% booked for 2021 and 2022, and getting quickly booked for 2023 and 2024 as well. With tight polysilicon supply expected to continue in 2021 and 2022, the Roth Capital analysts expect Daqo to continue to benefit from higher prices and further bookings coming its way (see 52,700 MT Polysilicon Order For Daqo New Energy).

Despite the strong fundamental business performance of Daqo, Philip Shen of Roth is seeing, he looks cautiously at the silicon company because of “potential risk that the U.S. government could take action to block imports from Xinjiang.” Adding, “That said, DQ is now in discussions with various US government agencies to identify a U.S. State Department approved third-party auditor to verify that no forced labor is being used at DQ’s facilities.”

Guidance

Daqo has guided for close to 19,500 MT to 20,500 MT polysilicon production in Q1/2021, and sell around 20,000 MT to 21,000 MT to external customers. In 2021, its guidance is to produce 80,000 MT to 81,000 MT, inclusive of the impact of the company’s annual facility maintenance.