- Markets

- Business

- People

- Opinion

- Technology

- Reports

- Our Events

- Tenders

- Price Index

- Top ModulesTop Modules

- ServicesServices

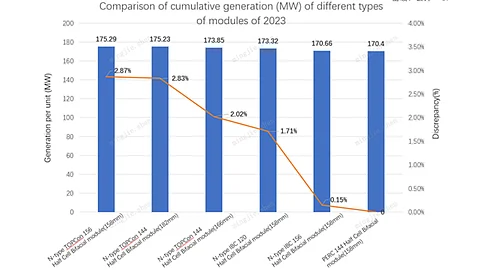

SPIC’s study data: The State Power Investment Corporation (SPIC) has released the latest comparison results for various solar PV technologies, from its 1-year outdoor experimental study on the energy yield performance. It studied the energy output of TOPCon biracial modules alongside biracial modules of PERC, heterojunction (HJT) and interdigitated back contact (IBC) solar panels from January 1, 2023 to December 31, 2023. The panels are installed at Daqing in northern China. According to SPIC’s results, TOPCon modules have the highest energy yield performance due to its higher bifacial rate and lower working temperature, which is 1.16% higher compared to IBC modules, 0.98% higher than HJT and 2.87% higher than PERC, according to SPIC. TOPCon was found to have the lowest degradation, specifically 1.57% to 2.51%, lower than PERC and HJT. TOPCon also exhibited better low light performance than IBC and PERC on cloudy days and during dawn and dusk as it has a better response to both short and long waves. SPIC carries out these annual tests, comparing empirical experiments in the real world. This data, stressed SPIC, provides a scientific basis and solid support for China to formulate industry policies and technical standards, and upgrade industry technology.

JinkoSolar’s overseas expansion: At the recently concluded Photovoltaic Industry Development Review in H1 2024 of the China Photovoltaic Industry Association (CPIA), JinkoSolar Vice President Jing Qian presented the company’s Overseas Version 2.0 plan. Under the strategy, the Chinese manufacturer aims to invest $985 million to establish 10 GW solar cells and 10 GW solar PV modules factory in Saudi Arabia’s OXAGON, the new city in NEOM. It will be set up in a joint venture (JV) with the Public Investment Fund (PIF) (see Solar Manufacturing Consortium In Saudi Arabia). The consortium targets to bring the world’s ‘1st’ desert PV factory online in the beginning of 2026 and mass produce high-efficiency solar cells of more than 27% efficiency. Qian reportedly said under Version 1.0, it was ‘selling out’, but under Version 2.0 its strategy is to ‘make out’. It is also part of the company’s carefully planned policy that foresees anti-dumping of Europe and the US on Chinese PV products becoming a norm, and competition continues to grow in the domestic market. Having a factory in Saudi Arabia will give it access to the growing market of the country as well as the larger Middle Eastern market. Building factories that can cater to global markets is the idea, and not limiting itself to a specific market alone. Right now, the manufacturer is starting with a Chinese supply chain, but it aims to eventually build a local industrial supply chain.

China promoting REITs: The National Development and Reform Commission (NDRC) of China has issued a notice on promoting the regular issuance of real estate investment trusts (REIT) in the infrastructure sector. Among the 13 industries that are identified by the commission as eligible to apply for the REITs are those in the energy sector. For renewable energy infrastructure, eligible projects include wind power, solar power, hydropower, natural gas, biomass, nuclear, storage and clean, flexible and high-efficiency coal power, including cogeneration. It also includes ultra-high voltage transmission projects, incremental distribution networks, microgrids, and charging infrastructure projects.

175 MW Spanish plant changing ownership: JinkoPower subsidiary Jinko Power Spain will sell 100% equity in its 4 subsidiaries to China Huadian’s Hong Kong subsidiary for a price of up to €175 million. The 4 subsidiaries, namely Universal Reward, S.L.U., We Are So Good, S.L.U., The Main Speed, S.L.U., and Good 2 Follow, S.L.U., are responsible for 175 MW Antequera PV Plant Project in Spain. It is currently under construction and scheduled to come online by September 30, 2025.

.png?w=50&fm=png)