The Indian government has allocated INR 220 billion ($3.08 billion) to the country's power and renewable energy sector in FY 2020-21 while the Ministry of New and Renewable Energy (MNRE) has been awarded an annual increase of 10.62% with INR 57.53 billion ($806.65 million) in India's annual Budget 2020.

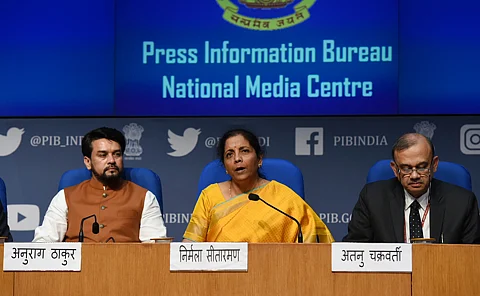

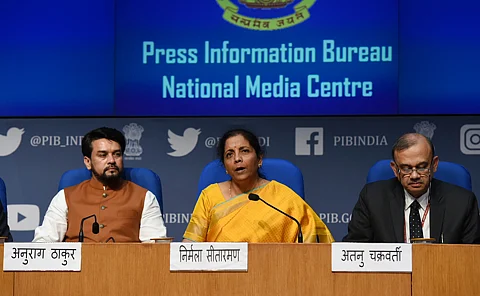

Some salient features that related to the power, renewable energy and specifically solar power sectors in the Budget 2020 speech of Indian Finance Minister Nirmala Sitharaman are:

This clause relates to basic customs duty (BCD), which means there will be no such duty on the import of solar cells and modules into the country. "Unless the earlier notification is amended to exclude the solar cells and modules from customs duty exemption, the items will continue to have 0% duty," stated Mercom.

The MNRE had earlier recommended the finance ministry to impose BCD on imported solar cells and modules with effect from April 1, 2021 in a bid to support domestic manufacturers (see MNRE For Customs Duty On Imported PV Cells & Modules).

Imported solar cells and modules coming into India from China and Malaysia are already expected to pay safeguard duty, which currently has come down to 15% from the previous 25% (see 25% Safeguard Duty Imposed By India).