- Mercom’s India Solar Market Update Q3/2018 shows India’s total solar PV capacity between January 2018 to September 2018 to have reached 6.6 GW

- In Q3/2018, solar PV addition of 1,589 MW was lowest compared to last two quarters, and also 30% drop from Q3/2017

- Cumulative rooftop solar capacity of the country reached 2.8 GW as of September 30, 2018, with 435 MW installed in Q3/2018

- Safeguard duty, lack of clarity around GST rates, land and transmission issues are to be blamed for the installations to have slowed down in India, according to Mercom, but it believes in the long-term potential of the market

- Mercom expects the country to add 8 GW of new PV in the calendar year 2018

That India’s solar PV market has slowed down over the last few months for various reasons is no breaking news. But it is time to see it in actual numbers. Mercom India Research says the country installed 6.6 GW of new PV capacity between January and September 2018. Large scale projects make up 81.5% (5,382 MW) and rooftop solar over 18% (1,240 MW) of the 9M/2018 installations.

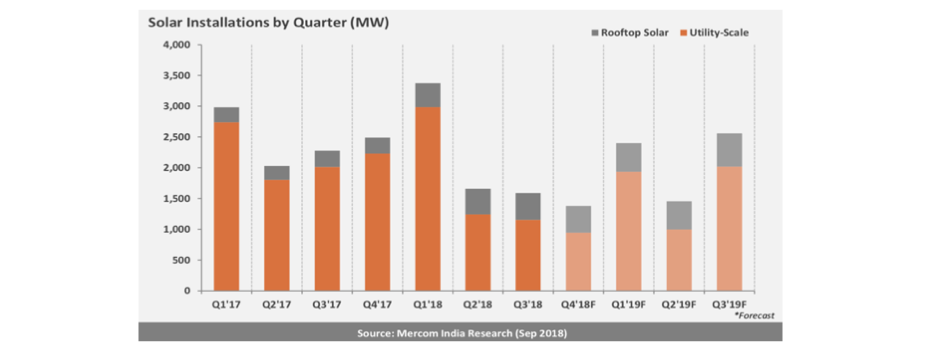

First quarter installations were the highest at 2,984 MW, followed by second quarter additions at 1,659 MW, making Q3/2018 additions the lowest in the year so far – with only 1,589 MW installed, which is 4% less than previous quarter, and 30% less than during the same period last year (see India’s QoQ PV Addition In Q2/2018 Drops 52%).

In comparison, the first 9 months of 2017 were a little better at more than 7 GW of installations compared to 9M/2018 (see India Added Over 7 GW In 9M/2017).

In its India Solar Market Update Q3/2018, Mercom said that during that quarter, large scale PV added 1,154 MW, compared to 1,244 MW in Q2/2018 and 2,013 MW in Q3/2017. Rooftop solar accounted for 435 MW, an improvement of 5% over 415 MW installed a quarter back and 64% increase from 265 MW last year.

Large scale solar and rooftop PV represented 73% and 27% shares in Q3/2018 installations, respectively. Overall, Mercom’s numbers show India’s cumulative rooftop solar capacity reaching 2.8 GW as of September 30, 2018, contributing only little to the cumulative installed capacity of 26 GW.

Karnataka led the states’ tally with more than 5.2 GW of cumulative installed capacity by end of Sept. 2018, followed by Telangana, another southern state.

Mercom Capital Group’s CEO and Co-Founder Raj Prabhu blamed the lower installation number on the slowdown in tender and auction activity last year. “The safeguard duty, lack of clarity around GST rates and land and transmission issues have all sapped the momentum from the solar market,” said Prabhu. “The Indian solar industry is trying to recover from the safeguard duty announcement. An acceptable tariff for both project developers and government agencies has been an ongoing challenge since the inception of India’s solar program.”

At the end of September 2018, India had 16 GW of under-construction large scale solar project pipeline, with 9.7 GW tendered and pending auctions. In the third quarter 2018, some 4 GW was tendered and more than 7.1 GW was auctioned. Mercom now expects the country to end calendar year 2018 with 8 GW of solar capacity installed, compared to additions of 9.78 GW in 2017. The consultancy anticipates the country may reach over 70 GW of cumulative solar power capacity by 2022, which is quite distant from the national target of 100 GW.

Nonetheless, the clean energy research and communications firm sees potential for solar PV in India in the long term despite the nagging issues of its Goods and Services Tax (GST) rates, continued challenges of land and transmission availability, as well as rupee depreciation and higher interest rates.

“In the long-term, prospects for solar remain bright in the country. The energy transformation in the country continues and 2018 maybe the first year where solar makes up over 50 percent of new capacity additions in India. Companies need to be able to play the long game if they want to be successful in the Indian solar market,” opined Prabhu.

The report can be purchased at Mercom India Research’s website.