7C Solarparken Reports Record High EBITDA For 2020

- 7C Solarparken grew it annual EBITDA for 2020 to a record high for the company at €42.9 million

- Company's total sales of €50.6 million in 2020 exceeded its forecast of €43 million

- By the end of 2021, it aims to report total portfolio of 295 MW, and 2020 EBITDA is guided as €42.5 million

German solar and wind energy independent power producer (IPP) 7C Solarparken, reached 256 MW capacity in its portfolio in October 2020, exceeding the target of 220 MW planned to be achieved by 2020. It was thanks to the company's acquisition of EnerVest Belgium in December 2020.

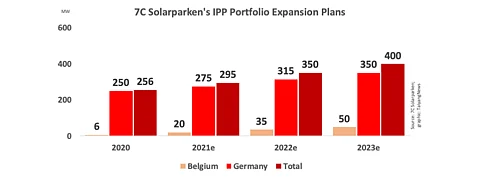

This 256 MW comprises 250 MW of solar systems or 97.7% of total portfolio and 6 MW or 2.3% of wind energy systems.

Management said EBITDA reached €42.9 million ($51 million), a record high for the group and growing 12.6% annually. Its sales grew from €43.1 million in 2019 to €50.6 million ($60 million) in 2020, exceeding the company's forecast of €43 million.

Electricity production from renewable energies for the group rose to 224 GWh, up from 171 GWh in the previous year.

For 2021, the German company is targeting an expansion of its IPP portfolio to a total of 295 MW, distributed as 275 MW in Germany, 20 MW in Belgium. By the end of 2022, it wants to scale up to 350 MW, divided as 315 MW in Germany and 35 MW in Belgium. By the end of 2023, the portfolio should increase to 400 MW of which 350 MW is aimed to be located in Germany and 50 MW in Belgium.

On the financial side, 7C Solarparken has forecast EBITDA of €42.5 million ($50.5 million) in 2021, slightly below the figure for 2020.

"We again delivered better figures than expected, but were certainly supported by above-average weather conditions. We even recorded a capacity growth of 66 MW during the financial year," said 7C Solarparken CEO Steven De Proost. Referring to its 400 MW target to be achieved by 2023, Proost added, "Achievement of this goal should be accelerated by our recent entry in Belgium as a second core market, although the average project size will be much smaller than in Germany. With the possibility of PPAs on site sign, especially with commercial electricity customers with a high electricity bill, we judge the market to be attractive."

Before the end of 2020, the company raised €13 million in a private placement through institutional investors towards a 500 MW portfolio target by 2023, of which it said 400 MW will be owned by the group (see 7C Solarparken Raises €13 Million In Private Placement).

.png?w=50&fm=png)