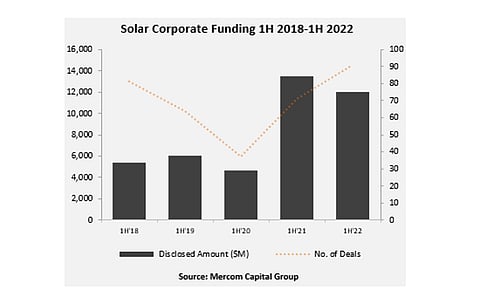

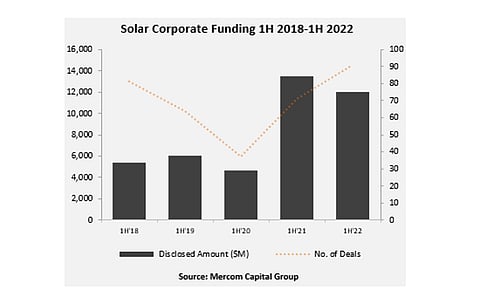

During H1/2022, solar sector attracted 11% lower global corporate funding of $12 billion, down from $13.5 billion in the previous year, thanks to factors as inflation, higher interest rates and supply chain issues, according to Mercom Capital Group.

In its latest 1H and Q2 2022 Solar Funding and M&A Report, the market intelligence firm said the total proceeds include $3.7 billion coming in from venture capital (VC) funding that went up 125% when compared to last year. Out of this 89% went to solar downstream companies with Intersect Power raising the largest share of $750 million (see $750 Million Investment For US Solar Developer).

Public market financing activity declined during the reporting period with $3.3 billion raised, a drop of 10% from H1/2021 (see Mercom: H1/2021 Global Corp Solar Funding Up 193% YoY).

With an annual decline of 39%, announced solar debt financing added up to $5 billion. There were a total of 5 securitization deals worth $1.4 billion, also a decline of 26% vis-à-vis $1.9 billion in the comparative period.

As for merger and acquisition (M&A) transactions, there were a total of 53 deals reported, led by Macquarie Asset Management consortium to take over Reden Solar (see Macquarie Invests In Reden Solar).

In H1/2022, 148 projects representing 38 GW solar power capacity exchanged hands, while in the previous year the number was 136 acquisitions worth 40 GW. Most project acquisitions in Q2/2022 were done by project developers and independent power producers (IPP) that picked up 4.1 GW capacity followed by 4 GW by oil and gas majors, and 3.4 GW by electric utilities.

Summarizing the findings, Mercom Capital's CEO Raj Prabhu said, "Even though the 1st half numbers held up, there was a pronounced slowdown from Q1 to Q2. Besides venture and private equity funding, all other areas experienced a decline in financing activity. But the value of solar is more evident than ever to markets that are dependent on energy imports. Clean energy installation goals are being ramped up around the world, and solar is a long-term beneficiary of this trend."

The 1H and Q2 2022 Solar Funding and M&A Report report can be purchased on Mercom Capital Group's website.