US based balance of systems (BOS) supplier for solar industry, Shoals Technologies Group managed to grow its quarterly and annual revenues in Q4/2021 and 2021, and announced new manufacturing facility in Portland, however, did not mention the departure of the company's Founder Dean Solon in prepared remarks.

Solon announced his resignation as a board member of the company to explore new opportunities in a LinkedIn post a few days back.

Pointing this out, Jeffrey Osborne of Cowen said, "We expect that the departure is likely going to be an overhang on the shares given he founded the company in 1996, and it is unclear what he does with his ~50% stake valued at over $1bn."

The manufacturing facility with undisclosed annual capacity in Tennessee has come up in a 219,000 sq. ft. space and will be operational in Q2/2022. "In addition to the expanded and enhanced manufacturing output, the new manufacturing space will bolster Shoals' ability to introduce innovations to the market by capitalizing on new product opportunities in the solar, energy storage, and electric vehicle charging sectors," stated the management.

Q4/2021

Meanwhile in Q4/2021, Shoals' grew its revenues by 24% YoY to $48 million, thanks to an increase of 29% in the System Solution revenue and 15% in Components. System Solutions business represented 68% of the revenue in the reporting quarter. Gross profit improved 7% to $15.9 million, but it suffered net loss of $-2.2 million due to higher general and administrative expenses and higher interest expense partially offset by a tax benefit.

2021

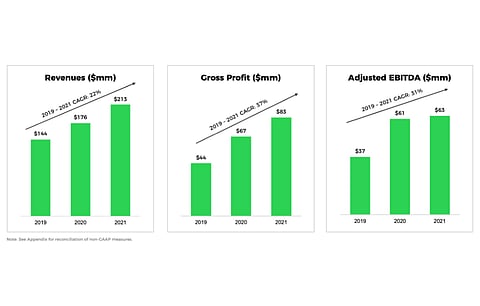

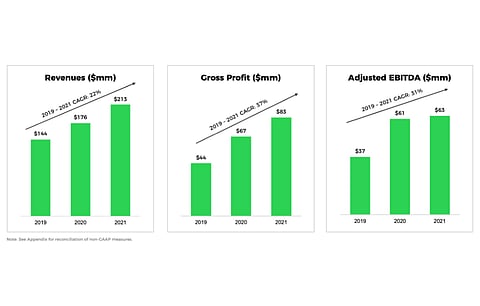

The company's annual revenues and gross profit for 2021 went up by 21% and 24% to $213 million and $83 million, respectively. For the entire year, the adjusted EBITDA was reported as $63 million, an increase of $2 million from the previous year.

At the end of 2021, its backlog and awarded orders represented a value of $299 million, having gone up by 94% YoY and 10% QoQ which it termed as a new record for the company.

Guidance

Shoals has revised its guidance downwards for Q1/2022 revenues to fall within the range of $68 million to $74 million, with adjusted EBITDA of $16 million to $20 million and adjusted net income of $10 million to $13 million (see Shoals Technologies Q3/2021 Financial Results).

For 2022, revenues are anticipated between $300 million to $350 million, adjusted EBITDA within $79 million to $97 million, and adjusted net income as $54 million to $69 million.

Regarding the guidance, Shoals CEO Jason Whitaker said, "Demand is incredible, but the exact timing of projects remains very dynamic because customers are contending with so many moving pieces within their supply chain. What that means for us in 2022 is that while we know our revenue growth rate is going to increase significantly compared to last year, it's challenging to predict exactly how significantly, and which quarters will see the greatest growth. And because of that uncertainty, we've tried to capture a wide range of potential outcomes in our 2022 revenue outlook."