A new Berkeley Lab report explores the strong continued investor interest in hybrid power projects in the US

Solar PV + battery storage remains the most popular configuration, even though PPA prices are quite high

Out of 2,734 hybrid projects, representing 667 GW of hybrid capacity in the interconnection queues at the end of 2023, solar PV + storage accounted for around 92%

At the end of 2023, the US had nearly 49 GW of operational hybrid power plant capacity, with the addition of 80 new plants representing 7.9 GW combined operational generating capacity and 21% year-on-year (YoY) growth last year. The latter comprised 3.6 GW/11.6 GWh of operational storage capacity, according to a new report by the Lawrence Berkeley National Laboratory.

Funded by the US Department of Energy (DOE), the report titled Hybrid Power Plants Status of Operating and Proposed Plants, 2024 Edition delves into the strong interest in hybrid projects as is visible in the pipeline of projects in the country’s interconnection queues.

According to the report, most of the largest PV + storage plants are located in California and the West, along with Texas and Florida. It seems to be the most popular combination for hybrids, even though there are other categories such as wind + storage, wind + PV, geothermal + PV, and also fossil-hybrid categories.

The Berkeley Lab analysts point out that the Inflation Reduction Act (IRA) provides access to Investment Tax Credit (ITC) to standalone storage projects, which should discourage investment in coupling battery storage with solar in a hybrid configuration. However, there is roughly equal growth of both hybrid and standalone storage capacity.

“It could be that the market still needs more time to react, but there are several countervailing reasons why the trend of hybridization might continue despite the standalone storage ITC, such as bypassing clogged queues or boosting a PV plant’s capacity credit, which ultimately might outweigh other considerations. We will continue to track this trend in future reports,” is their explanation.

The preference for PV + storage points to storage offering firming capacity or resource adequacy, and energy arbitrage or the ability to shift power sales from lower- to higher-priced periods. Provision of grid services remains the most popular use case for storage, but energy arbitrage has increased in popularity in the last 4 years, point out the analysts.

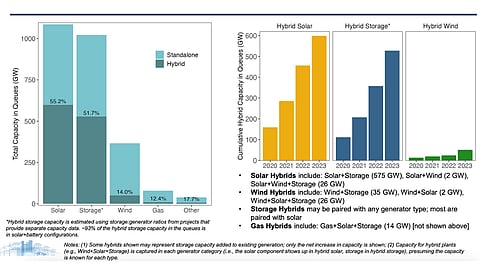

The continued strong investor interest in hybridization is clear by the fact that there was roughly 667 GW of such project capacity in the interconnection queues at the end of last year. Solar PV + storage accounts for around 92% of the 2,734 hybrids this represents.

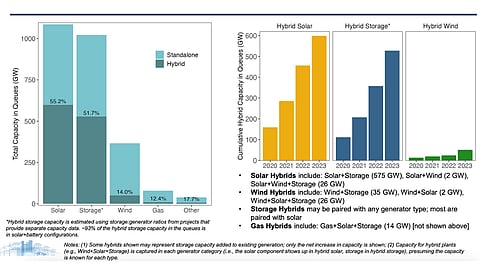

Of the 1.086 TW of solar power plants in the nation’s queues, 55% or 599 GW capacity was proposed as hybrid projects, most typically paired with battery storage. Another 51 GW of wind capacity, mostly paired with battery storage, was proposed as a hybrid – representing 14% of all wind capacity (366 GW) in the queues.

More than half of the storage capacity in the queues is estimated to be part of a hybrid plant.

The analysts point out, “While many of the plants proposed in the queues will not ultimately reach commercial operations, the depth of interest in hybrid plants—especially PV+storage—is notable, particularly in certain regions. For example, in CAISO, 98% of all solar capacity and 34% of all wind capacity in the queues is proposed as a hybrid.”

Additionally, almost 95% of hybrid capacity in the queues is requesting to come online before 2029, dominated by solar + battery projects.

The report also looks at prices under power purchase agreements (PPA) from a sample of 105 PV + storage totaling 13 GW of PV and 7.8 GW/30.9 GWh of batteries. It found an increase in the levelized PPA prices since 2020. The levelized storage adders for such plants on the mainland have recently increased to $10,000/MW/month, $80/MWh-stored, and $35/MWh-PV, depending on the storage ratio.

Yet, this is also not acting as a dampener on the plans. “The well-publicized impact of inflationary and supply chain pressures on prices in 2022 could also be a short-term contributor, though battery prices have more recently hit all-time lows,” reads the report.

The report is available for free download on Berkeley Lab’s website.