US solar tracker supplier Array Technologies exited Q3/2022 with a 173% annual increase in revenues, driven by the acquisition of STI Norland, excluding which the revenue increase was 112% thanks to 63% improvement in shipments and 29% in ASPs.

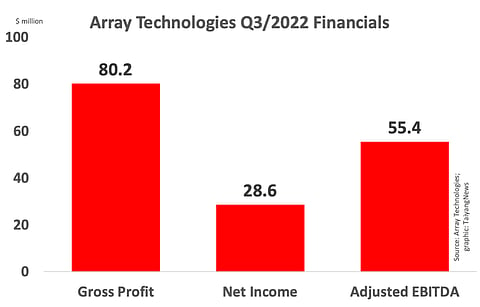

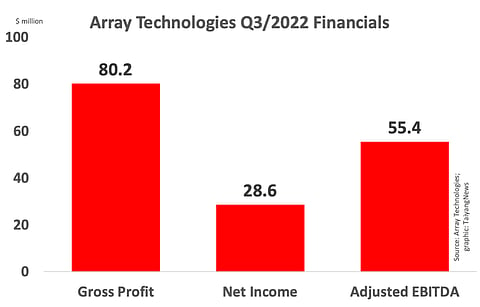

The acquisition and organic growth contributed to 1260% annual growth in gross profit that settled at $80.2 million. It also turned profitable reporting a net income of $28.6 million and adjusted EBITDA of $55.4 million, compared to $-27.56 million and $-3.9 million a year back, respectively (see Array Technologies Q3/2021 Financial Results).

Philip Shen of Roth Capital Partners believes that even as Array's financial results were strong for the reporting quarter, he cautioned that the company may need to watch out for module detentions under Uyghur Forced Labor Prevention Act (UFLPA).

Array's total executed contracts and awarded orders at the end of September 2022 were worth $1.8 billion, having gone up 77% annually and comprised $1.4 billion from Array Legacy Operations and $0.4 billion from STI. This cumulative includes $400 million worth orders booked during the quarter as large customers seek to 'lock in capacity' and reap benefits of domestic content requirements under the Inflation Reduction Act (IRA).

Shen referred to management remarks on efforts to increase the share of domestic content in its existing product line from 75% now to 95% that can be accomplished with 'minor tweaks' to the balance of material (BOM).

Management has also updated its 2022 guidance to now expect revenues between $1.50 billion to $1.60 billion, up from $1.30 billion to $1.50 billion. Adjusted EBITDA is now anticipated to fall within the range of $122 million to $132 million while the previous guidance was $120 million to $140 million (see Higher Revenue And Losses In Q2/2022 For Array Technologies).