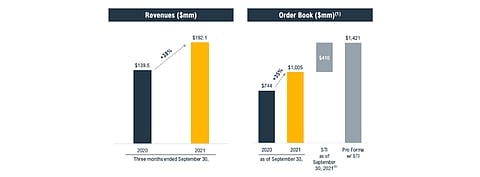

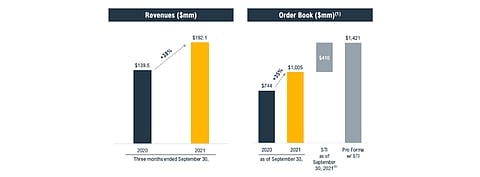

Strong demand and higher shipments in Q3/2021 improved Array Technologies, Inc. revenues by 38% YoY to $192.1 million. Yet, higher raw material inputs and logistics costs pulled down its annual gross profit by 65% to $9.3 million. Gross margin too decreased to 4.8%, but was partially offset by greater absorption of fixed costs.

As a result, the American tracker supplier's net loss for the reporting quarter widened from $7.2 million last year to $31.00 million, as adjusted EBITDA dropped to a loss of $-0.5 million.

Battling higher costs due to project delays and higher freight costs, Array's CEO Jim Fusaro said things are improving as prices are 'stabilizing, albeit at higher levels'. He admitted passing on the higher costs to its customers. Like compatriot BOS company Shoals Technologies, Array's optimism springs from the fact that there have been no cancellations so far and project pipeline are swelling 'in every geography' (see Shoals Technologies Q3/2021 Financial Results).

Array's own order book at the end of September 30, 2021 was worth $1.005 billion of executed contracts and awarded orders, with Q3/2021 contributing more than $315 million of new orders as the 2nd highest level of quarterly bookings in its history.

Management also pointed out that it sources up to 90% of its bill of materials (BOM) from US based suppliers, which could turn out to be a 'tremendous competitive advantage if the proposed domestic content requirements of the current Build Back Better Act are enacted into law'.

"The domestic supply chain we have built is helping us to take market share and positions us to be an even bigger winner as US content evolves into a competitive differentiator and with our acquisition of STI Norland we now are equally well positioned to accelerate our international growth," added Fusaro.

The company believes the acquisition of STI Norland makes it the world's 'largest tracker company (see World's 'Largest' Solar Tracker Company).

Company CFO Nipul Patel shared that as it clears lower priced backlog of orders and dissipates the 'hangover' effect on its margins from those legacy orders, it expects to achieve the previously declared FY 2021 targets at the lower end (see Revenue Up, Gross Margin Down For Array Tech. In Q2/2021). Shipments delayed from Q4/2021 will lead to higher revenues in Q1/2022.

Commenting on the company's financial results, financial analyst Jeffrey Osborne of Cowen opined, "While management echoed near-term incorrigible supply chain issues, we are encouraged by Array's strategic path toward margin recovery, optimized logistics, and market share gain via international expansion. Policy should bolster sentiment, but we see margins critical."