US-based utility-scale solar tracker supplier Array Technologies has reported a 22% YoY drop in MWs shipped in Q3/2023, resulting in its revenues declining 32% to $350.4 million. A 12% decrease in ASP, driven by lower input costs, was also responsible.

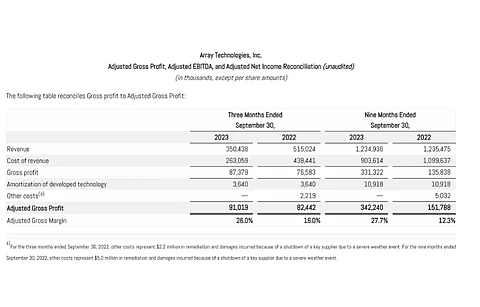

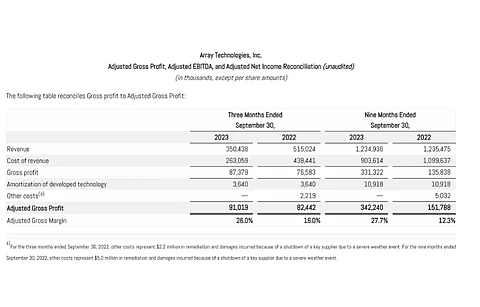

While its gross profit improved 14% to $87.4 million, the gross margin increased to 24.9% from 14.9% last year as the company passed the pricing to customers and implemented cost-saving measures in freight and material purchases.

Nonetheless, its net income dropped to $10.1 million in the reporting quarter, compared to $28.4 million in the previous year (reported as $28.6 million earlier) which the company attributes to a $42.8 million legal settlement it received in Q3/2022. Adjusted EBITDA grew slightly to $57.4 million from $55.4 million in the previous year (see Array Reports $28.6 Million Net Income In Q3/2022).

"On the demand side, we continue to see positive momentum heading into 2024. We are seeing a steady increase in our domestic pipeline, which has more than doubled from the second quarter. This increase is a key early indicator of the expected momentum in our orderbook," said Array CEO Kevin Hostetler.

Its total executed contracts and awarded orders as of September 30, 2023 were a total of $1.6 billion, comprising $1.4 billion from the Array legacy operations and $0.2 billion from STI Norland.

Around $80 million worth of orders were canceled from the STI orderbook in Brazil. Dubbed forgiveness day by the Brazilian authorities under Normative Resolution (REN) 1065/2023, the canceled projects included renewable energy facilities with a secured contract for the use of the transition system (CUST) that never entered into commercial operation or could not be executed on time. The amnesty allowed the grants to be revoked and CUST terminated without the payment of fines, Array explained.

Hostetler added that the company continues to be impacted by short-term delays in project timing driven by customer pushouts. Due to this, it has lowered revenue forecast for year 2023 to within $1.52 billion to $1.57 billion, down from the previous rolled-back guidance of $1.65 billion and $1.72 billion. Adjusted EBITDA is guided within the range of $280 million to $290 million (see Strong Q2/2023 Financial Results For Array).

"However, despite these project timing challenges, we continue to be encouraged by our operational execution, in particular our efforts to expand our non-tracker offerings which will drive better than anticipated margins for the second half of the year," shared Hostetler.

Array has also announced Kurt Wood as its new chief financial officer (see Senior Leadership Change At US Tracker Maker).