Australia’s Solar Sunshot program shouldn’t be geared towards setting up domestic PV manufacturing capacity alone, says a new report

It should encourage import diversification and strengthen links with manufacturers in Southeast Asia, India and America

The initiative should make use of both onshoring and friendshoring tactics to diversify all segments without significantly raising costs

Australia’s Solar Sunshot initiative targets to onshore solar PV supply chain and reduce its reliance on China. However, to truly ensure energy security and build resilience in the supply chain, it will need to deeply engage with global supply chains, says a new report by the United States Studies Centre (USSC) at the University of Sydney.

Australia aims to support domestic solar PV manufacturing industry development through the AUD 1 billion Solar Sunshot program by offering production subsidies and grants (see Australia Announces AUD 1 Billion For Solar Program).

The report writer Georgia Edmonstone, a research associate with the Economic Security Program at the USSC, presents key lessons from the history of solar trade and industry policies in the US to outline the security argument for Australia to diversify its solar supply chain.

In the report titled Should Australia make solar panels? Supply chain security through global engagement, Edmonstone argues that Australia should pursue an import diversification strategy and strengthen links with manufacturers in Southeast Asia, India and America.

The 2 major learnings from the US example are for Australia to balance its domestic manufacturing ambitions with ‘friendshoring’ efforts to diversify all segments of the supply chain without significantly raising costs; and for its trade and industrial policies to focus on the entirety of the supply chain and not just the end product.

The current global solar PV supply chain is dominated by the Chinese as 97% of the world’s solar wafers and ingots are manufactured in China, and 85% of modules too. The country also produced close to 88% of the world’s solar cells in 2023.

While the thought behind breaking free from the Chinese dependence by setting up a local supply of solar PV manufacturing capacity is being pursued by governments globally, Edmonstone points out that Australia’s Solar Sunshot is, at the end of the day, an industrial policy that comes with a price.

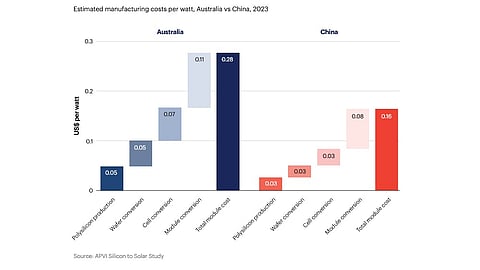

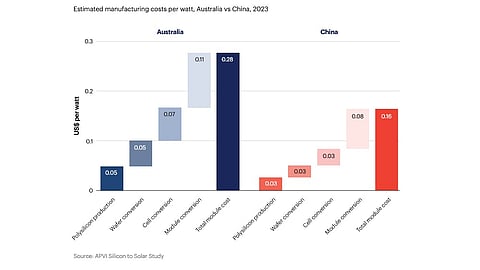

Compared to China, the cost of solar manufacturing in Australia is much higher. Also, an industrial policy for solar PV manufacturing can come with risks, including lobbying for subsidies and protection, inefficient allocation of resources, or disincentivizing innovation, she points out.

Even though China runs factories at economies of scale, experience shows that the solar industry is prone to boom-and-bust cycles. Even at present, with the overcapacity challenges, the average utilization rate of some solar factories in China is only around 50%, hurting business margins.

Such a situation will not be feasible for Australia. Taking a cue from the US, Australia must look at creating a cost-effective supply chain for solar panels, according to the report. This means not necessarily building everything in the solar supply chain on its own, but seeking trusted partners across the globe too, rather than depending only on China as it is now.

This entails the country aligning its Solar Sunshot investments to focus on supply chain resilience with an import diversification strategy for the segments of the supply chain it may not be able to domestically fulfill. The report recommends Australia to:

make targeted export-focused investments in certain segments of the supply chain and consider global supply chain resilience in project funding,

forge closer links between Australian consumers and overseas manufacturers in India, Southeast Asia, and the US, and

leverage diplomatic and education networks to advocate for Australia’s role in the global supply chain.

“Australia has an opportunity, not just to on-shore but to fill niche gaps in the global solar supply chain and, in so doing, build resilience in this supply chain,” said USSC Director of Economic Security Hayley Channer. “In this way, Australia can multiply its industrial policy output by supporting global trade flows at the same time it looks more inwards for solutions.”

The report is available for free download on USSC’s website.