The global investment in energy transition reached a record high of $2.1 trillion in 2024, according to BloombergNEF

It was led by electrified transport, renewable energy and power grids, which accounted for 90% of the total

Renewable energy investment of $728 billion also included investment in solar energy

Analysts believe the target of net zero by 2050 requires an average of $5.6 trillion annually from 2025 to 2030 to stay on track

Electrified transport, renewable energy and power grids drove the global investment in low-carbon energy transition to expand by 11% year-on-year (YoY) to a record $2.1 trillion in 2024, according to Bloomberg New Energy Finance’s (BloombergNEF) Energy Transition Investment Trends 2025 report. These 3 investment areas accounted for 90% of the total investment last year.

It was the electrified transport that took up the lion’s share at $757 billion as investors spent on passenger electric vehicles (EV), electric 2- and 3-wheelers, commercial electric vehicles, public charging infrastructure and fuel cell vehicles.

Renewable energy came next with a $728 billion investment last year. This includes investment in solar, wind, biofuels, biomass and waste, marine, geothermal, and small hydro. Power grids took in another $390 billion of the total, while energy storage settled at $54 billion. This was a record year of investment for all of these sectors.

“Our report shows just how much growth we’ve seen in the energy transition over the past few years, despite political uncertainty and high interest rates,” said Deputy CEO of BNEF Albert Cheung. “There is still much more that needs to be done, especially in emerging areas like industrial decarbonization, hydrogen and carbon capture, in order to reach global net-zero goals.”

Cheung believes a ‘true partnership’ between the private and public sectors is the only solution to unlock the potential of these technologies.

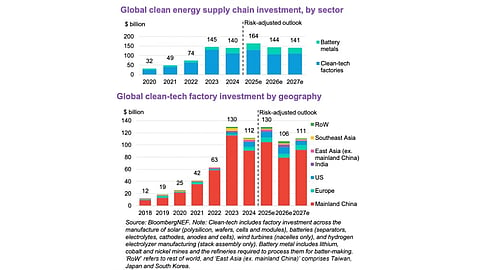

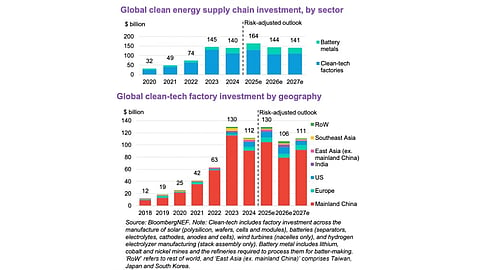

In terms of global clean-tech factory investment that includes factory investment across the manufacturing of solar comprising polysilicon, wafers, cells and modules, among other technologies, the total added up to $112 billion, down from $130 billion.

According to the report writers, clean energy supply chains, including equipment factories and battery-metal production assets saw a $140 billion investment last year, down from $145 billion in the previous year.

It is likely to grow to $164 billion this year even though solar, battery, battery metals and electrolyzer manufacturing are all in a state of overcapacity. Production expansion is expected to take place outside mainland China, yet supply chain investments are threatened by the lack of manufacturing experience, high local costs and political risks in regions like India, US, and Europe that attempt to onshore supply chains. China will continue to account for the bulk of spending for ‘years to come.’

Nevertheless, this record high of $2.1 trillion is not enough for the world to get on track for global net zero by 2050 in line with the Paris Agreement. This is only 37% of what is required to get on track. BloombergNEF analysts believe getting to this goal requires an average of $5.6 trillion annually from 2025 to 2030.

A summary of the report is available for free download on BloombergNEF’s website.