Canadian Solar’s Q2 2024 revenues and gross margin were in line with the guidance

Higher shipments contributed to net revenues increasing 23% QoQ, partially offset by lower module ASPs

Guides for FY 2024 module shipments to between 32 GW and 36 GW, down from 35 GW to 40 GW guidance offered previously

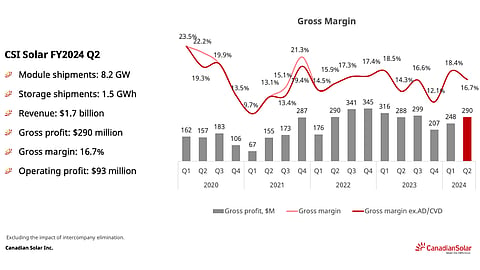

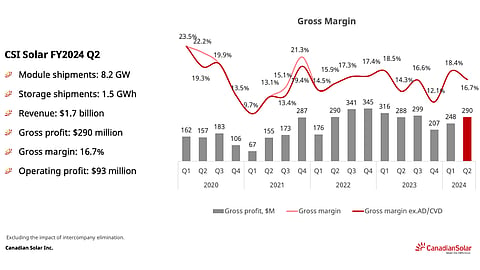

Canada-headquartered vertically integrated solar PV manufacturer Canadian Solar exited Q2 2024 having met its revenue and gross margin guidance; however, the company has reduced its shipment and revenue guidance for FY 2024.

Its solar module shipments of 8.2 GW exceeded the guided range of 7.5 GW to 8.0 GW, and revenues of $1.6 billion were in line with the $1.5 billion to $1.7 billion forecast. Gross margin of 17.2% was also within the guided range of 16% to 18%.

The company’s module shipments increased 30% quarter-over-quarter (QoQ). While , net revenues registered a 23% QoQ increase, they decreased 31% year-over-year (YoY). The company attributes the increase in revenues to higher module shipment volume, partially offset by a decline in the module average selling price (ASP). Top 5 module shipment markets for the company were China, the US, Pakistan, Germany, and Brazil.

The drop in module ASP along with lower project sales were responsible for the annual decline in revenues, partially offset by higher battery energy storage solutions (BESS) sales.

The company reported net income of $4 million for the period, compared to $12 million in the previous quarter and $170 million in the same period last year.

While its storage backlog of late-stage BESS projects grew to $2.6 billion, backed by a record 66 GWh of pipeline at the end of June 2024, its total solar project development pipeline stood at 27.4 GW, comprising 1.7 GW under construction, 4.8 GW in backlog and 20.9 GW in advanced and early-stage pipelines.

As for manufacturing, the management has revised its expansion targets to now aim for 25 GW, 31 GW, 48.4 GW and 61 GW of annual ingot, wafer, cell and module production capacity to be achieved by September 2024, respectively.

During the last earnings call, it had announced plans to expand ingot capacity from 20.4 GW in March 2024 to 50.4 GW by December 2024, wafer capacity from 24 GW to 50 GW, cell capacity from 48.4 GW to 55.7 GW, and module capacity from 58 GW to 61 GW.

“Despite challenging market dynamics, CSI Solar achieved strong results in the first half. Amidst fierce industry competition, we maintained our focus on profitability while also increasing volume this quarter,” said CSI Solar President Yan Zhuang.

He added, “As polysilicon prices further declined, the resulting price decreases across the upstream supply chain helped reduce manufacturing costs. Given the current industry landscape, we have decided to delay certain upstream investments to further prioritize profitability. In these situations, our partial vertical integration affords us strategic agility.”

At the recently concluded SNEC 2024 in Shanghai, China, Zhuang sat down for an exclusive interview with TaiyangNews Managing Director Michael Schmela where he discussed the company’s path to profitability and its future growth initiatives (see SNEC Exclusive: TaiyangNews’ Michael Schmela Interviews Canadian Solar’s Yan Zhuang).

Guidance

Canadian Solar’s revised shipment guidance for FY 2024 is 32 GW to 36 GW of modules, down from the 35 GW to 40 GW range shared during the last earnings call. The company forecasts BESS shipments to range from 6.5 GWh to 7.0 GWh, and revenues are expected to range from $6.5 billion to $7.5 billion.

For Q3 2024, the management forecasts revenues within $1.6 billion to $1.8 billion, and gross margin between 14% and 16%. It expects to ship 9.0 GW to 9.5 GW of modules during the quarter, including 100 MW for own projects.

For BESS, the Q3 guidance is for 1.4 GWh to 1.7 GWh shipments, including about 1.2 GWh for own projects.

Canadian Solar’s Senior VP Global Sales, Thomas Koerner, will be at the Solar Made in USA Conference on September 9, 2024 in Anaheim California that TaiyangNews is hosting in collaboration with EUPD Research and RE+. He will talk about successfully establishing cell and module production fabs in the US. Register for the event here.