Europe was the largest solar module export market for China in 2023 even though its December 2023 intake declined 4% month-on-month (MoM), says InfoLink Consulting. Going forward, it expects weakening demand in various markets to restrain imports of Chinese modules globally in Q1/2024.

In December 2023, Asia Pacific took the largest volume of 6.6 GW out of 16.2 GW modules China shipped during the month. India led the numbers as it took in about 2.9 GW which was some 35% sequential drop from 3.9 GW in November 2023. Out of 20.5 GW the region purchased from China in Q4/2023, India imported 9 GW thanks to the demand from utility scale projects.

The Indian interest is also due to the developers stockpiling ahead of the Approved List of Models and Manufacturers (ALMM) coming into force from April 2024. InfoLink adds that if the government exempts projects that have already placed module orders from following ALMM guidelines, expect a shipment surge by the end of March 2023.

Meanwhile, India was also the biggest market for Chinese cells, taking in 1.5 GW in December. In H1/2024, the country is likely to see domestic manufacturing projects coming online that might impact demand for Chinese modules.

Europe imported 5 GW of Chinese modules in December with its quarterly volumes totaling 29.5 GW, 32.9 GW, 22.9 GW, and 16.1 GW in all the 4 quarters of 2023, respectively. InfoLink says traditional low season in Q4 and inventory accumulation led to the quarterly imports decreasing.

The European inventory remains high even as some countries are directing these panels to other markets. Nonetheless looking at the Red Sea issue, distributors are intent on procuring more modules. InfoLink analysts expect the rapid inventory depletion to prompt Europe to restock in advance.

More modules whose orders were placed at the end of 2023 should be en route due to extended shipping time from China. Most of these modules are TOPCon so they expect import volumes to sustain. Spot FOB prices for TOPCon modules in mid-January 2024 ranged between $0.11/W to $0.13/W.

That said, electricity prices are coming down in Europe, negatively impacting residential demand.

Chinese shipments to the Americas declined by 13% MoM to 2.7 GW, led mainly by Brazil's 2.1 GW. Brazil's Law 14.300 encouraging distributed generation segment of less than 5 MW in size was a major contributor to the demand. Installation rush to beat the 9.6% import duty imposition on solar panels was also one of the reasons.

Appetite for Chinese solar modules increased from the Middle East by 25% MoM to 1.5 GW as 1.1 GW went to Saudi Arabia alone. Utility scale tenders in H2/2023 stimulated the demand, and is likely to sustain in 2024 as well.

Chinese module shipments to Africa decreased 21% MoM to 407 MW in December 2023 as demand from the major markets of South Africa and Egypt went down. Demand will nevertheless pick up in South Africa with the country launching REIPPPP round 7 (see South Africa Launches REIPPPP Bid Window 7).

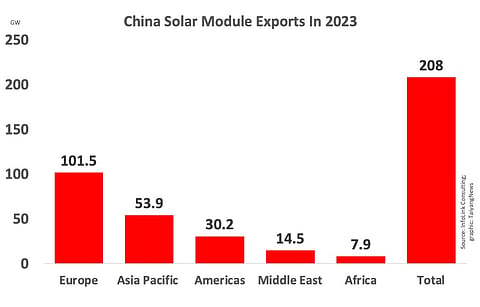

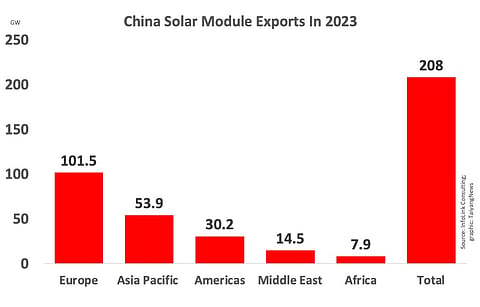

Overall, China exported 208 GW modules last year with a 34% annual increase over 154.8 GW in 2022. Of this volume, 101.5 GW were shipped to Europe, compared to 86.6 GW in 2022. Asia Pacific imported 53.9 GW, Americas 30.2 GW, Middle East 14.5 GW, and Africa 7.9 GW.