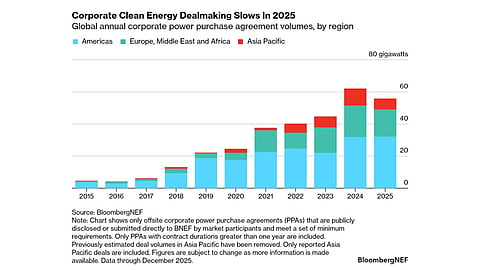

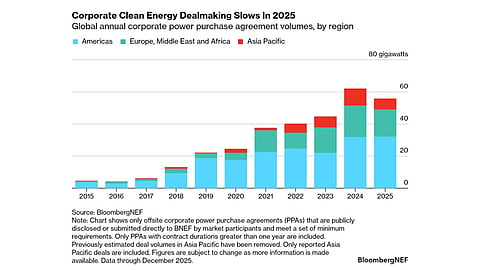

Global offsite corporate PPA volumes dropped to 55.9 GW in 2025 from a record 62.2 GW in 2024; BloombergNEF says this is the first annual fall in almost 10 years

The US-led activity with 29.5 GW signed, mainly by large tech firms; however, the number of unique US corporate buyers fell 51% YoY to 33, as smaller companies pulled back

India and South Korea slowed, while Japan and Malaysia showed continued corporate interest supported by maturing markets and regulations

Buyers are increasingly exploring hybrid and firm clean power options, including solar-plus-storage and nuclear PPAs

BloombergNEF tracked 5.8 GW of co-located and hybrid deals in 2025, with battery cost declines supporting this trend

Global offsite corporate clean energy offtake activity suffered a decline of 10% year-over-year (YoY) in 2025 to 55.9 GW, compared to a record volume of 62.2 GW in the previous year, says Bloomberg New Energy Finance (BloombergNEF).

It highlights that this was the first time in nearly a decade that the power purchase agreement (PPA) signing spree declined. Analysts attribute the drop in the 1H 2026 Corporate Energy Market Outlook to uncertainty around government policies and changes in electricity prices.

According to the BloombergNEF report, most of the policy uncertainty existed in the US last year, yet it was still the largest market with a record 29.5 GW deals signed by the Big Tech (the largest 6 technology companies). Combined with high project costs, policy uncertainty led to smaller players being less active. BloombergNEF says the number of unique corporate buyers in the US declined 51% YoY to 33.

There was a decline elsewhere as well, albeit for different reasons. Increasing hours of negative power prices and ‘eroding value of standalone solar and wind deals’ had buyers exploring hybrid portfolios. The Europe, Middle East, and Africa region had corporates signing up for 17 GW PPA capacity, down 13% YoY.

Slowdowns in India and South Korea led to PPA volumes coming down from 10.7 GW in 2024 to 6.9 GW in 2025. On the other hand, countries like Japan and Malaysia in the Asia Pacific continue to see significant interest among corporates for clean energy driven by a maturing PPA market and regulatory support, respectively.

Among offtakers, Meta and Amazon were the largest companies representing a combined 20.4 GW, led mainly by solar, but also including nuclear power. Together with these 2 firms, Google and Microsoft accounted for 49% of all global activity last year and signed up for 5.6 GW of nuclear energy.

“Corporate clean energy buyers are operating at two different speeds. Large tech buyers are venturing into bigger deals and frontier technologies, while smaller companies are grappling with power market realities. Some buyers in newer markets are just familiarizing themselves with the concept of offtake agreements altogether,” observes BNEF Corporate Clean Energy Analyst and Lead Author of the report, Nayel Brihi.

Additionally, there was uncertainty around the Greenhouse Gas (GHG) Protocol, which plans to update its Scope 2 carbon accounting rules that could have contributed to the decline in procurement activity last year, according to the report.

GHG Protocol guides companies on reporting their emissions. Under the upcoming rules, companies may need to track their electricity use on an hourly basis and follow stricter location rules. If this happens, it will be harder for most companies to prove they use 100% renewable energy, the analysts observe.

The largest supplier of clean energy to corporates last year was Engie, with 3.6 GW contracted globally. One clear trend the analysts point to on the supplier side is the increase in the share of clean, firm-power offering baseload products. This includes co-located solar and storage, hybrid solar and wind, or nuclear PPAs.

BloombergNEF tracked 5.8 GW of co-located and hybrid deals last year. It expects their share to continue to expand. As battery costs continue to decline, hybrid deal structures will likely become the norm, it says. In a recent report, BloombergNEF says the global benchmark cost for a 4-hour battery project fell by 27% YoY to $78 MWh in 2025.

Brihi adds, “For the market to return to growth, we will need to see clean, firm power supply options such as co-located solar and storage delivering at scale, and at competitive prices.”