Daqo’s Q2 2025 revenue fell to $75.2 million from $123.9 million in Q1 due to lower sales

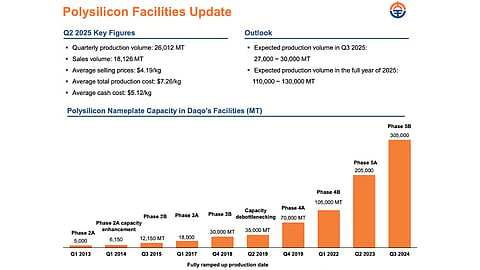

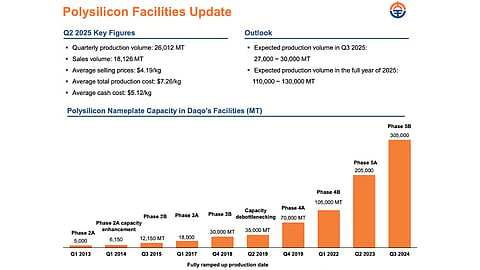

Polysilicon production reached 26,012 MT, but utilization remained low at 34% amid weak market demand

Average selling price declined to $4.19/kg, while production costs decreased 4% to $7.26/kg

Net loss was $76.5 million, narrower than last year, supported by a debt-free, strong balance sheet

Chinese polysilicon producer Daqo New Energy has reported revenues of $75.2 million in Q2 2025, down from $123.9 million in Q1 and $219.9 million a year earlier. The decline was driven by lower sales volumes amid persistent industry overcapacity and price pressures across the solar value chain.

Amid challenging market conditions and weak selling prices, Daqo says it operated its nameplate capacity at a reduced utilization rate of approximately 34%. The company met the production guidance with 26,012 MT at its 2 polysilicon facilities. However, its sales volumes dropped to 18,126 MT from 28,008 MT in Q1 as it scaled back new sales orders in anticipation of future price recovery, going by the efforts of the Chinese government.

As a result, idle facility costs were around $1.38/kg due to lower utilization, largely reflecting non-cash depreciation. Meanwhile, cash costs declined 4% sequentially to $5.12/kg, and total polysilicon production cost fell 4% to $7.26/kg, aided by lower raw material and energy costs.

The average selling price (ASP) for polysilicon in Q2 2025 was $4.19/kg, down from $4.37/kg in the previous quarter (see Daqo New Energy Narrows Down Q1 2025 Net Loss To $71.8 Million).

Daqo New Energy CEO Xiang Xu shared, “The solar PV industry faced continued challenges in the second quarter of 2025 with market prices across the solar value chain declining due to industry overcapacity and high inventory levels, remaining below cash cost levels. As a result, Daqo New Energy recorded quarterly operating and net losses. Nevertheless, we maintained a strong and healthy balance sheet with no financial debt.”

Nevertheless, during the reporting period, Daqo suffered a gross loss of $81.4 million, which it managed to narrow down from a loss of $159.2 million in Q2 2024, and slightly down from $81.5 million in Q1 2025.

Net loss for the polysilicon producer was $76.5 million, having gone up from $71.8 million in Q1 2025, but lower than $119.8 million it reported for the same period in 2024 (see Daqo Blames Low Polysilicon ASPs For Q2 2024 Negative EBITDA).

According to the company’s unaudited financial results, its non-GAAP EBITDA of -$48.2 million was an improvement compared to -$144.9 million in Q2 2024, but stayed relatively flat compared to Q1 2025.

Management now guides for Q3 2025 production volumes to range within 27,000 MT to 30,000 MT, and between 110,000 MT and 130,000 MT for the full year, down slightly from the previous guidance range of 110,000 MT to 140,000 MT.

Daqo believes that industry self-discipline and the Chinese government’s anti-involution regulations will be helpful for the PV industry going forward.

“Looking ahead, Daqo New Energy is well positioned to capitalize on the long-term growth in the global solar PV market and strengthen its competitive edge by enhancing its higher-efficiency N-type technology and optimizing its cost structure through digital transformation and AI adoption,” added Xu.