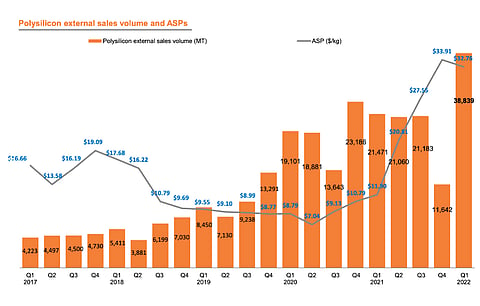

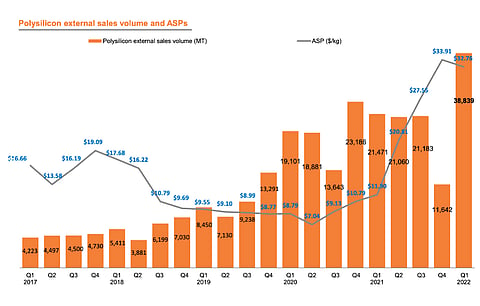

The average selling price (ASP) of polysilicon during Q1/2022 for Daqo New Energy dropped to $32.76 per kg compared to $33.91 per kg in the previous quarter, but it did not dampen the Chinese company's prospects as it increased its revenues for the quarter over 3 times on QoQ basis.

Daqo's average production cost for polysilicon in the 1st quarter of 2022 was $10.09 per kg, down from $14.11 per kg in the last quarter due to a decrease in the cost of silicon powder, manufacturing efficiency improvements and better economies of scale.

In the reporting quarter, it produced 31,838 MT of polysilicon, 33% more than the previous quarter out of which 97.2% was mono-grade. Its polysilicon sales volume totaled 38,839 MT with high demand which brought in $1.28 billion in revenues, partially offsetting impact of lower ASPs. Thus, revenues increased by 4 times compared to $256.1 million in Q1/2021 (see Daqo New Energy Pockets $256 Million Revenues In Q1/2021).

Gross profit of $813.6 million went up from $239.8 million in Q4/2021 and $118.9 million in Q1/2021.

Philip Shen of Roth Capital Partners said, "With the successful ramp of Phase 4B and the progress being made on the 100k MT capacity addition planned for 2022 (Inner Mongolia), we see potential for higher volumes vs. our prior expectation."

The Chinese company expects to start production in Inner Mongolia in Q1/2023 then ramp up in the next quarter which would lead to an addition of 70,000 MT to 80,000 MT in the total output for 2023." We believe Phase II, which is expected to add an additional 100k MT of polysilicon capacity, could potentially be available in 2024 if the previously announced private placement follow on offering is approved by the Shanghai Stock Exchange and the CSRC," added Shen.

Daqo management expressed confidence for the US and Chinese governments to solve the issue regarding the company's name appearing alongside several others Chinese companies listed in the US in the list of US government's HFCAA. It recently stated that this may lead to it being delisted from the US stock exchange by early 2024 (see Daqo Fears Delisting From US Stock Exchange).

In Q2/2022, the company targets to produce approximately 32,000 MT to 34,000 MT of polysilicon, and in 2022 the aim is to hit 120,000 MT to 125,000 MT which will be inclusive of the annual maintenance of its fab.