DMEGC Solar’s H1 2025 solar revenues rose 36.58% YoY to RMB 8.05 billion

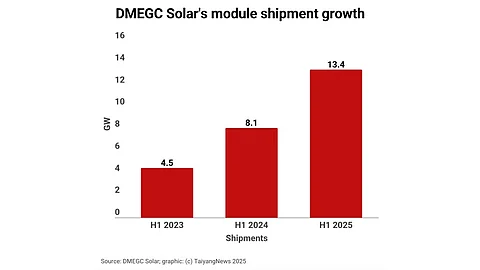

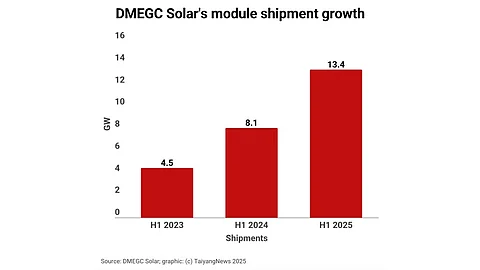

Solar PV shipments jumped 65% YoY to 13.4 GW amid industry overcapacity challenges

DMEGC’s current operational production capacity stands at 23 GW for cells and 21 GW for modules

Chinese solar PV manufacturer DMEGC Solar bucked the industry trend and reported a 36.58% year-on-year (YoY) increase in its H1 2025 solar revenues that totaled RMB 8.05 billion ($1.12 billion).

The solar business contributed to the company’s group operating revenues of RMB 11.94 billion ($1.66 billion), which also operates in the magnetic materials and lithium battery industries. Group revenues improved by 24.75% YoY, while net profit rose by 58.94% to RMB 1.02 billion ($142 million) for the period.

The company’s total solar PV shipments also registered a YoY jump of 65% to 13.4 GW. This improved from 8.1 GW in the previous year, which was an increase of 78% over the year prior.

The Chinese manufacturer admits that the solar PV industry is facing risks from changing global policies, overseas market uncertainties, exchange rate fluctuations, and potential overcapacity if demand lags behind production. Technological changes and raw material price volatility also pose challenges for the industry. Manufacturers need to quickly adapt to maintain competitiveness, manage costs, and ensure stable supply chains for sustained growth, it adds.

DMEGC explains how it navigated the overcapacity-driven tough business environment during the period when manufacturers managed with low-capacity utilization rates and operational difficulties. The management attributes the growth in its solar business to its expanded global presence and strengthened competitiveness, which it says was achieved by optimizing production costs, improving cell efficiency, and launching innovative products.

Its current portfolio includes 5 categories of double-glass products and 9 special-application categories. The company stated that the efficiency of its solar cells increased to 26.85%, while R&D efficiency rose to 27.25%.

DMEGC’s current operational solar cell production capacity stands at 23 GW, while module capacity is 21 GW. It has a lithium-ion battery capacity of 8 GWh.