Enphase Energy reported Q2 2025 GAAP revenues of $363.2 million, up 3% QoQ in the US and 11% in Europe

Its non-GAAP gross margin dipped to 48.6%, as US reciprocal tariffs reduced margin by ~2 percentage points

The company shipped 1.53 million microinverters and 190.9 MWh batteries; it now targets non-China cells for its batteries by the end of 2025

US-headquartered solar PV microinverter and battery systems supplier Enphase Energy was well placed in Q2 2025, as it reported $363.2 million in GAAP revenues, and over $37 million in net income.

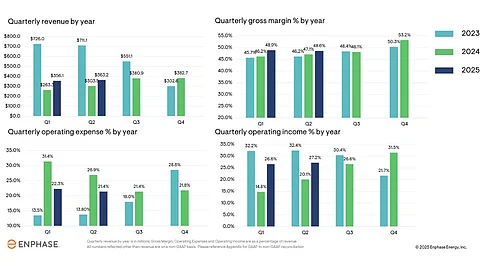

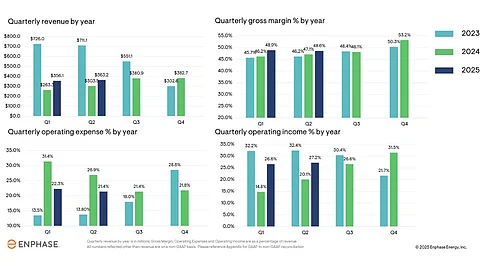

Its revenues for the quarter increased by approximately 3% quarter-on-quarter (QoQ) in the US, owing to seasonality, partially offset by lower safe harbor revenues of $40.4 million, compared to $54.3 million in Q1 2025 (see Q1 2025 In Line For Enphase Energy; Expects Tariff Impact In Q2).

Europe continues to seek more of Enphase, as the company reported close to 11% QoQ increase in revenues from the region. The company attributes the growth in Europe to higher microinverter and battery sales, as it continued to ramp up shipments of IQ Battery 5P with FlexPhase.

Enphase reported a non-GAAP gross margin of 48.6%, which was slightly down from 48.9% in the previous quarter. Minus the net benefit from the Inflation Reduction Act (IRA), the gross margin was 37.2% in Q2 vis-à-vis 38.3% in Q1 this year. The company admits that the reciprocal tariffs imposed by the US government had a negative impact of approximately 2 percentage points (PP) on its margins.

It shipped around 1.53 million microinverters, totaling 675.4 MW DC, in Q2 this year from its US manufacturing facilities, which were booked for 45X production tax credits (PTC). IQ Battery shipments totaled 190.9 MWh, up from 170.1 MWh in Q1. The management shared that it has 210 MWh of batteries currently enrolled in virtual power plant (VPP) programs globally.

During Q2, Enphase started shipping its 4th-generation Enphase Energy System, which includes the IQ Battery 10C, IQ Meter Collar, and IQ Combiner 6C, to customers in the US. It has also started shipping the IQ Balcony Solar Kit in Belgium and Germany.

Currently, the company is producing IQ Battery 5P in the US using locally made components, with cells sourced from China. On the company’s earnings call, Enphase President and CEO Badri Kothandaraman shared that these batteries exceed 45% domestic content, helping its customers qualify for investment tax credit (ITC) bonuses.

Enphase is gearing up for non-China cell production, with a target of end-2025, enabling full compliance with evolving domestic content and Foreign Entities of Concern (FEOC) regulations by 2026.

Responding to queries related to restrictions on clean energy tax credits, Kothandaraman said that the company expects an accelerated shift towards leases and PPAs anchored by the Section 48W tax credit through 2027. He also sees batteries becoming central to every solar sale, thanks to declining costs and long-term tax credit support through 2033 under One Big Beautiful Bill Act (OBBBA).

Enphase is also making efforts to make solar lease financing easier and available to more installers, including smaller ones. Kothandaraman said that this will help more homeowners adopt solar.

The company projects its Q3 2025 revenues in the range of $330 million to $370 million, including 190 MWh to 210 MWh of IQ battery shipments. GAAP operating expenses will likely range between $130 million and $134 million. GAAP gross margin is expected to be within 41% to 44% with net IRA benefit, including around 3 to 5 PP of new tariff impact.

Net IRA benefit is guided within a range of $34 million to $38 million based on estimated shipments of 1,200,000 units of its US-made microinverters.