Enphase Energy’s Q4 2024 business was driven by the US market, which grew by 6% QoQ

It continued to report positive operating income, which expanded from $10.23 million in Q4 2023 to $54.8 million in the reporting quarter

For Q1 2025, Enphase targets revenues in the $340 million to $380 million range

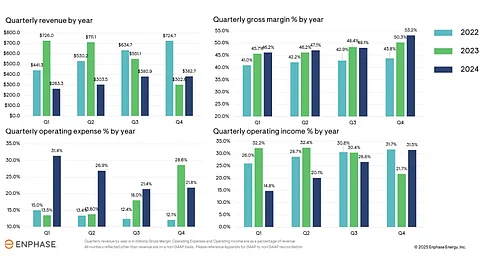

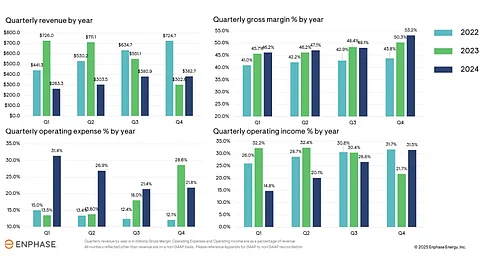

US-headquartered solar PV microinverter and battery systems supplier Enphase Energy reported positive GAAP operating income for yet another quarter in Q4 2024 with $54.8 million, compared to a negative $10.23 million in Q4 2023.

The company also expanded its net income to $62.16 million during the reporting quarter from the previous quarter’s $45.7 million. Its quarterly revenue of $382.7 million was up slightly from the previous quarter, meeting the upper end of its guidance of $360 million to $400 million, thanks to higher microinverter sales.

Enphase saw its US revenue increasing close to 6% quarter-on-quarter (QoQ), but further softening of demand in the European market saw its quarterly revenues in this market drop by close to 25%. Here, President and CEO Badri Kothandaraman said, the market is transitioning from solar-only systems to solar+batteries which avoids export penalties and allows participation of residential solar+battery systems in energy markets.

Citing lower solar penetration in France, Kothandaraman called it a key long-term market for the company. In Q4 2024, it started shipping the company’s IQ EV chargers into France, and in Q2 2025, the plan is to introduce hot water heater compatibility to enable homeowners to do ‘heating with excess solar car green heating.’

Overall, the US and international revenue mix for Enphase was 79% and 21%, respectively. Recently, the company also announced the integration of its Enphase Energy System into Octopus Energy’s smart tariffs in the UK (see Enphase Energy Integrates With Octopus Energy’s Smart Tariffs In UK).

Its quarterly shipments of 1.69 million microinverters came from its contract facilities in the US that were booked for 45X production tax credits. The quarter also saw the company shipping its IQ8HC, IQ8X, IQ8P-3P microinverters and IQ Battery 5Ps with higher domestic content than previous models, all produced in the US.

Enphase also shipped 152.4 MWh of IQ batteries during the period, a number that declined from 172.9 MWh that it shipped in Q3 2024 (see US Market Drives Enphase Energy’s Q3 2024 Revenues).

In FY 2024, Enphase reported $1.33 billion in revenues, reflecting a drop from $2.29 billion in the previous year, and a gross margin of 47.3%. Operating income declined as well from $445.7 million to $77.29 million. Net income contracted from $438.9 million to $102.6 million.

Enphase now targets to start 2025 with $340 million to $380 million in Q1 revenues, including 150 MWh to 170 MWh of IQ battery shipments. This includes close to $50 million of safe harbor revenue. GAAP gross margin is guided within the range of 46% to 49%, with a net Inflation Reduction Act (IRA) benefit that’s expected to be $36 million to $39 million.

For FY 2025, it expects GAAP and non-GAAP annualized effective tax rates with IRA benefit, excluding discrete items, to range from 17% to 19%.