In its latest report, LevelTen Energy believes solar PPA prices in Europe have started to stabilize

The 1.3% QoQ increase seen in Q3 2024 was mainly due to an increase in prices in Italy and Hungary

Corporate sustainability commitments, AI-driven data centers and hydrogen sector growth will drive clean energy growth in the future

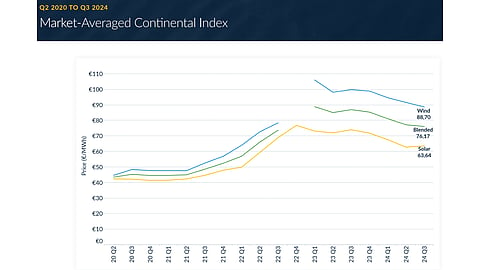

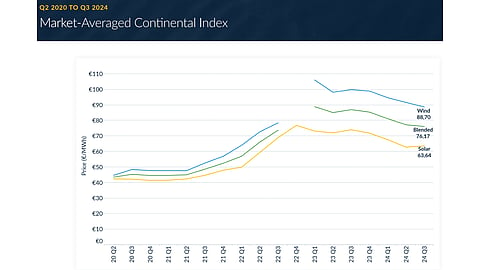

After years of inflation and market volatility pulled downward pressure on solar power purchase agreement (PPA) prices in Europe, things have started to achieve balance as LevelTen Energy reports P25 prices have gone up by a modest 1.3% quarter-on-quarter (QoQ) in Q3 2024, for the 1st time in last 4 quarters.

This increase leading to €63.64/MWh, was mainly contributed by rising solar PPA prices in Italy and Hungary.

According to LevelTen’s latest report titled 2024 Q3 PPA Price Index Europe, solar PV development is now gaining momentum in central and eastern European nations including Romania, Bulgaria, Slovakia and Hungary. This geographical diversification of solar PV growth in Europe is sure to bring in more offtake opportunities for potential buyers.

Ireland also made its debut on LevelTen’s index pointing at the growth of solar PPAs in the country. This demand is set to grow in the future as data centers dot the country’s landscape.

“Corporate sustainability commitments will continue to drive competition for contracts with mature projects that can provide strong economic outcomes and ensure procurement timelines are met,” according to LevelTen analysts. “At the same time, significant demand growth from AI-driven data centre expansions expected across much of the continent, and the continued development of Europe’s renewable hydrogen sector, are poised to absorb substantial amounts of clean energy capacity in the coming years.”

Nevertheless, developers should see some relief coming in with the European Central Bank announcing its 2nd interest-rate cut in 4 months, in September 2024, while the Bank of England is expected to follow suit. LevelTen believes that these rate cuts should further soften the substantial financing pressure that the developers have been facing over the last few years.

The complete report is available to LevelTen’s subscribers on its website.