Indian credit ratings agency CRISIL Ratings believes India is likely to see 16 GW of new solar PV capacity addition in fiscal year 2023, its fastest annual to date. It attributes this forecast to the steady decline in solar module prices since October 2022 that contributes to an improvement in the internal rate of return (IRR) of 45 GW of pure-play utility-scale solar project pipeline awarded since fiscal 2021.

Of this 16 GW forecast, more than 5 GW has already been commissioned till September 2023. In comparison, India installed 12 GW within fiscal year 2022. Further the analysts anticipate improving returns to help implement remaining 29 GW out of 45 GW over fiscals 2025 and 2026.

CRISIL points out that the 45 GW pipeline excludes rooftop and open access capacities that it expects at 2 GW to 3 GW of annual additions. Earlier, JMK Research & Analytics pegged calendar year 2023 solar installations in India at around 15 GW (see Indian Solar Installations Dropped 19% In H1/2023).

Analysts note that COVID-19-related disruptions along with transmission issues related to protecting the Great Indian Bustard (GIB) and the rise in module prices had slowed down solar installations in fiscal years 2022 and 2023.

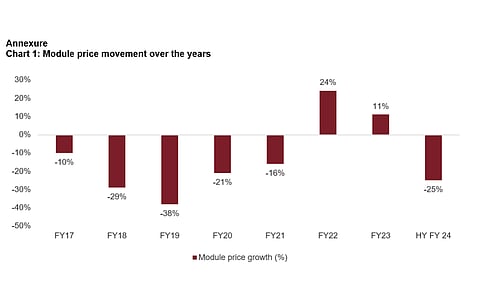

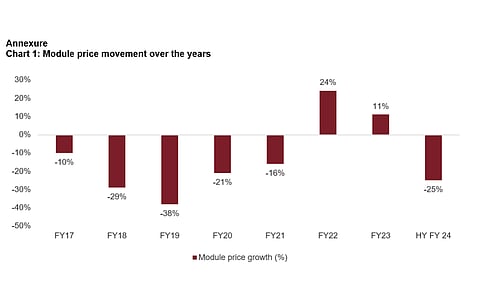

Now, the situation is reversing since module prices are on the downhill as new polysilicon capacities come online globally and there is a decline in demand for polysilicon from competing industries as automotives and computing.

Additionally, challenges related to the pandemic are now over and analysts say there is clarity regarding the protection of the GIB in terms of installing bird diverters on extant and new low-voltage transmission lines. Its execution is expected to be hastened by fiscal 2026.

Pandemic-related commissioning deadline extensions provided relief to solar projects helping them defer module purchases in times of high prices, thus saving some 20 GW projects auctioned during fiscals 2021 and 2022 from becoming unviable.

Compared to the last fiscal, module prices have softened – down ~30% as of September 2023 compared with the average last fiscal, leading to project IRRs improving by as much as 300-500 basis points (bps) to ~9%, on average.

The decline in solar module prices is also boosting Chinese solar panel sales in India, as InfoLink Consulting noted a 112% month-on-month (MoM) module shipment increase from China in September, despite the Basic Customs Duty (BCD). InfoLink analysts expect the demand for Chinese modules in India to remain elevated till March 31, 2024 till the ALMM exemption is in place (see China Exported 19.8 GW Solar Modules In Sept. 2023).

"Softer module prices will also benefit 25 GW of capacities bid during and since fiscal 2023," opined CRISIL Ratings Associate Director Varun Marwaha. "These 25 GW of projects had higher bid tariffs (Rs 2.5-2.7 per unit) compared with those awarded in prior fiscals (below Rs 2.5 per unit), as they factored in higher module costs, and should see their IRR improve 200-300 bps now that module prices have eased."

Nonetheless, CRISIL analysts add a caveat saying the projections are sensitive to the impact of geopolitical issues on supply chains or the levy of additional duties to protect the interests of domestic manufacturers that could pull down the IRRs of solar projects.