First Solar’s Q2 2025 net sales rose 30% QoQ to $1.1 billion, driven by shipments of 3.6 GW

Its bookings increased post-OBBBA, but 1.1 GW of cancellations from Southeast Asia exposed tariff-linked uncertainties

The manufacturer has earned $373 million in liquidity with Section 45X tax credit sales, to be completed by year-end

It has also revised FY 2025 guidance, anticipating stronger H2 sales despite global trade headwinds

Leading solar PV manufacturer in the US, First Solar shipped 3.6 GW of solar modules in Q2 2025 and increased net sales by over 8% year-over-year (YoY), and almost 30% quarter-over-quarter (QoQ). Riding on strong demand for domestic products, progress at its Louisiana and Alabama plants, and favorable policy tailwinds supporting domestic manufacturing, the management has nudged its full-year guidance upward.

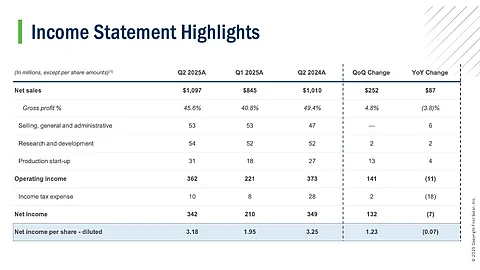

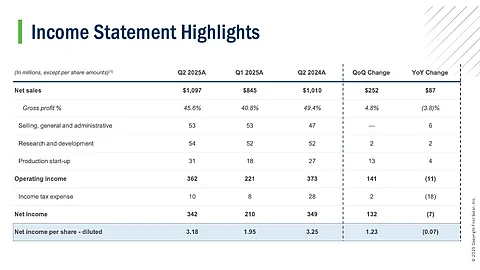

An increase in the volume of modules shipped pushed up its net sales to $1.1 billion, while gross profit increased by 4.8% to 45.6% in Q2. Operating income also increased by $141 million in the previous quarter to $362 million, while net income of $342 million improved over $210 million in Q1 2025, but declined by $7 million on an annual basis.

The company sold 3.6 GW of solar module capacity during the reporting quarter, including 2.3 GW from its US manufacturing facilities. It produced 4.2 GW, including 2.4 GW in the US and 1.8 GW internationally.

At the end of July 2025, the manufacturer also entered into a new tax credit transfer agreement to sell up to $391 million of Section 45X tax credits to an unidentified buyer. It says this has generated up to $373 million in proceeds to be realized in 3 installments by the end of this year.

Section 45X of the Advanced Manufacturing Production Credit (AMPC), under the Biden-era Inflation Reduction Act (IRA), incentivizes solar manufacturers to produce various components locally. They are also at liberty to sell these clean energy tax credits to a 3rd party.

Bookings

First Solar booked 900 MW of new gross bookings in H1 2025, followed by 2.1 GW of new orders in July following the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025. However, it also recorded 1.1 GW of contract terminations, including 900 MW produced at the company’s Malaysia and Vietnam factories due to policy uncertainty and increased tariff pressure. This volume was later re-contracted at $33 cents/W. It received $63 million in cancellation payments. Earlier this year, First Solar announced plans to lower Series 6 solar module production from its Malaysia and Vietnam fabs by 1 GW in 2025 (see First Solar To Cut Series 6 Production From SE Asia Factories).

At the end of June 30, 2025, First Solar had 61.9 GW of total contracted backlog worth $18.5 billion, which increased to 64 GW as of July 31, 2025. Out of this, close to 11 GW relates to the international Series 6 panels. Its total pipeline stands at 83.3 GW, and mid-to-late stage booking opportunities at 20.1 GW. This does not include bookings for its India-made panels as it has not received full security against the offtake.

Guidance

First Solar has revised its 2025 outlook to account for newly imposed US tariffs on imports from the Southeast nations of Malaysia and Vietnam, and anticipated AD/CVD tariffs against exports from India. It admitted that while these raise international sales costs and logistics challenges, adding to customer uncertainty, the company’s management sees these as temporary. In the long term, it expects to benefit from a more level playing field that these tariffs and investigations will create.

According to the manufacturer, existing tax credits for projects started by the end of 2024 and finished by 2028 remain unchanged, which supports its current US contracts. The new tax credit rules of the Trump administration are likely to drive fresh demand as projects that commence construction by July 4, 2026, will be eligible for tax credits under the changed rules. As tighter rules on foreign materials begin, First Solar expects to secure orders and may even look at the business case to establish one or more lines in the US, shared the management.

“In our view, the recent policy and trade developments have, on balance, strengthened First Solar’s relative position in the solar manufacturing industry,” said First Solar CEO Mark Widmar. “In addition, we believe that on a fundamental basis, with its cost-competitive energy and faster time to power profile, the case for utility-scale solar generation is compelling regardless of the policy environment, which places First Solar, a utility-scale leader, in a position of strength.”

Citing strong demand from the domestic market and $63 million in contract terminations received during Q2, it has raised net sales guidance for the year to $4.9 billion to $.57 billion for 16.7 GW to 19.3 GW of volume sold, including 5.0 GW to 6.0 GW in Q3. This compares to its previous guidance of $4.5 billion to $5.5 billion and 15.5 GW to 19.3 GW.

Analysts at Roth see an upside for First Solar going ahead as the US Customs and Border Protection (CBP) goes for ‘greater enforcement or re-enforcement' of the Uyghur Forced Labor Protection Act (UFLPA). While this re-enforcement may be 6–12 months, it could boost First Solar's prospects in terms of higher priced modules.

Additionally, First Solar provided an update to the patent infringement lawsuit for TOPCon technology, which it launched in July 2024. During the reporting quarter, the company filed a patent infringement lawsuit against Canadian Solar and its related entities, following the initiation of a similar move against China’s JinkoSolar and its related entities in February 2025.