First Solar has reported net sales of $4.2 billion in FY2024, including $1.5 billion in Q4

Its year-end contracted backlog of 68.5 GW included net bookings of 4.4 GW last year

The company targets to sell 18 GW to 20 GW of modules in 2025, comprising up to 3 GW in Q1

Leading US-based solar PV manufacturer First Solar exited FY2024 with strong financial results having expanded its net sales by over 27% year-on-year (YoY) with $4.2 billion, shipping a ‘historic’ volume of 14.1 GW. It now targets 26% to 38% annual growth in 2025.

First Solar’s Q4 2024 net sales of $1.5 billion improved by $0.6 billion from the previous quarter thanks to increased module sales. It also earned 37.5% gross profit during the reporting quarter and expanded net income by $80 million quarter-on-quarter (QoQ) to $393 million. Operating income too increased by $135 million QoQ to $457 million.

During 2024, First Solar produced 15.5 GW of solar modules comprising 9.6 GW of Series 6 and 5.9 GW of Series 7. It secured net bookings of 4.4 GW during the year, contributing to its year-end contracted backlog of 68.5 GW. The company counts an opportunity pipeline of 80.3 GW including 21 GW in mid-to late-stage. The majority of this exists in North America.

By 2026, the company targets to reach a nameplate capacity of over 25 GW, including 14 GW in the US. The company’s 3.5 GW DC Louisiana factory is on track for commissioning in H2 2025 (see First Solar Breaks Ground On 5th Manufacturing Fab).

Technology roadmap

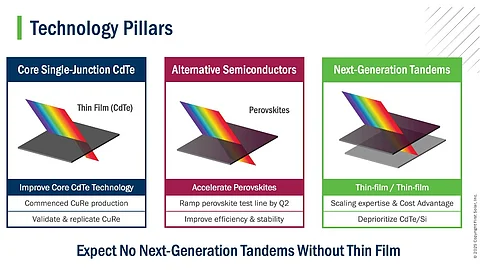

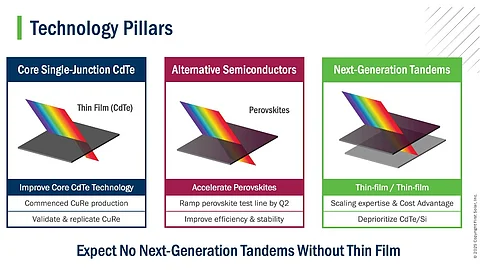

First Solar CEO Mark Widmar shared the company’s technology strategy roadmap as the thin-film solar PV manufacturer competes against crystalline silicon and goes a step further in the development of next-generation technologies.

The first pillar, he said, centers around its core single junction cadmium telluride (CdTe) technology and its continued improvement. In Q4 2024, it commenced the pilot production of CuRe, short for its proprietary copper replacement technology. These modules have been deployed in the field. Learnings from their field deployment will follow the company converting its Ohio lead line to CuRe technology in Q1 2026. The initial production run will guide its replication across the company’s fleet.

First Solar’s second pillar will be next-generation thin-film perovskites for which it plans to start the operations of a dedicated perovskite development line in Ohio by Q2 2025. It has been researching this technology at the California Technology Center, supported by the company’s Evolar acquisition (see US Solar Panel Maker Expands To Europe For Next Gen Tech).

In a bid to be future-ready, the American manufacturer is also eyeing pitching the thin film for tandem devices. Widmar explained, “In other words, our view is there is no tandem without thin film. While we previously explored the possibility of a crystalline silicon CadTel tandem product, we believe the energy and efficiency benefits of a fully thin film approach provides a more likely path to a future transformative device and are therefore prioritizing our research into the structure.”

Guidance

For FY2025, First Solar forecasts net sales of between $5.3 billion and $5.8 billion, with a gross margin of $2.45 billion to $2.75 billion. Operating income is expected to be within $1.95 billion to $2.3 billion.

The company targets modules sales of 18 GW to 20 GW this year, starting with 2.7 GW to 3.0 GW in Q1. Out of the full-year volume guidance, it plans to produce and sell 9.5 GW to 9.8 GW capacity in the US, and close to 1 GW to be produced and sold in India.

It estimates the global ASP of around $0.29/W, including the benefit of certain technology, commodity and freight adders, whereas the cost per W for production is guided as around $0.20/W and the cost per W sold will be close to $0.24/W.