Fluence Energy achieved close to $2.7 billion in revenues during FY 2024, representing 22% YoY jump

Revenues were largely driven by Europe and Asia markets that now represent 40% of its business

The strong business case of renewables with storage makes it confident that the US government change will not impact demand here

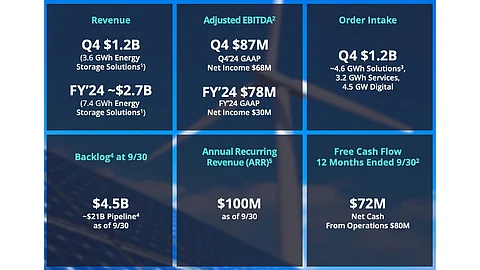

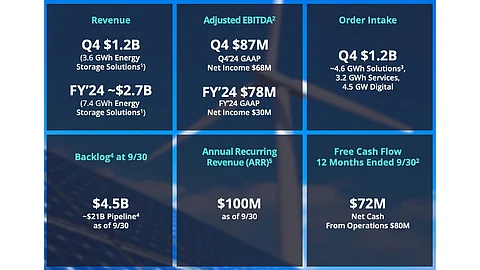

US-based energy storage and software provider for renewables and storage industries Fluence Energy exited FY 2024 (period ending September 30, 2024) with $2.699 billion in revenues, representing 22% in year-on-year (YoY) growth, against the guidance of $2.7 billion and $2.8 billion.

On quarter-on-quarter (QoQ) basis, it achieved around $1.2 billion in revenues in Q4, representing close to 82% increase and its highest quarterly revenue. A Siemens and AES company, its net income of $67.7 million during the quarter pulled it out of FY 2023 net loss to achieve an annual net income of $30.4 million.

Adjusted EBITDA of $78 million during the year exceeded guidance which the management says reflects better project execution as some of the projects were completed under projects.

Revenue growth was especially strong in Europe in Asia. Both these regions represent 40% of the company’s business, up from 30% over the last 2 years.

During the reporting quarter, it booked $1.2 billion worth of orders, compared to around $737 million booked in Q4 2023. With this, its backlog went up to around $4.5 billion as of end of the reporting period. It increased from $2.9 billion as of September 30, 2023.

Buoyed by this, the management projects revenues within $3.6 billion and $4.4 billion for FY 2025 (period ending September 30, 2025), with a midpoint of $4 billion. At present, it explained, some 65% of the midpoint of this guidance is covered by its current backlog.

It anticipates FY 2025 revenue split as 20% in H1 and 80% in H2. Due to this, adjusted EBITDA of $160 million and $200 million range is expected to be in the negative during the 1st half.

Philip Shen of Roth MKM commented, “FLNC started FY'24 with $1.8bn of 12-month backlog, or 67% of the actual $2.7bn of revenue delivered. We believe the back half weighting increases the risk of projects slipping into FY'26, while we continue to believe a slowing market and downward trend in battery ASPs provide headwinds to growth.”

Commenting on the change of guard in the US administration, Fluence does not see any significant impact on its US demand as this market understands that ‘real load growth is served fastest and most economic with renewables + storage’.

Fluence Energy President and CEO Julian Nebreda said, “As we look forward, we see unprecedented demand for battery energy storage solutions across the world, driven principally by the U.S. market. We believe we are well positioned to continue capturing this market with our best-in-class domestic content offering which utilizes U.S. manufactured battery cells.”