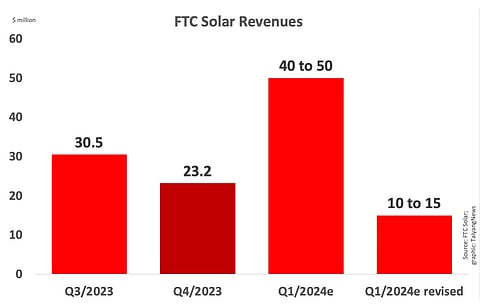

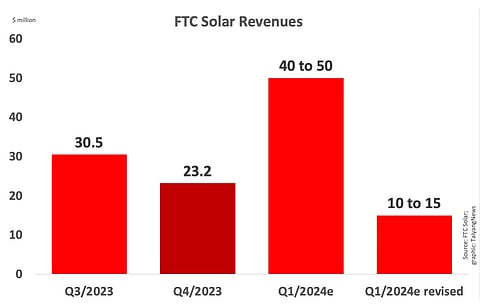

US solar tracker producer FTC Solar says its Q4/2023 revenues were impacted by lower product and logistics volumes and expects to report further drop in revenues in Q1/2024. It does see sequential growth in the following quarters.

The company met the guidance with $23.2 million revenues in the reporting quarter, which was a decline of 24.1% sequentially and 11.5% annually. Its gross profit of $0.7 million was 3% of the total revenue, compared to $3.4 million making up 11.1% of the revenue in Q3/2023.

FTC managed to narrow down its GAAP net loss to -$11.2 million from -$16.9 million in Q3/2023 and -$25 million in Q4/2022. Its adjusted EBITDA loss was -$10.1 million.

Chairman of the Board of FTC Solar, Shaker Sadasivam said, "The company's fourth-quarter results were in line with our targets. Along with those results, the company is making good progress advancing key initiatives that will support the company's future growth and profitability."

He listed the initiatives as improved customer engagement and enhanced product portfolio to accelerate project contracting, reducing product cost to improve gross margin, lowering the breakeven revenue level through continued operating efficiencies.

For the full year 2023, the company's total non-GAAP revenues of $127 million increased from $123 million in the previous year. Adjusted EBITDA was a negative at -$34.14 million.

However, Philip Shen of ROTH MKM observed that that the company's growth momentum hit a rough spot when JinkoSolar and LONGi modules were detained by the US Customs and Border Protection some time back. Since then, while these Chinese manufacturers continue to sail smoothly in the US market, FTC has been struggling with volume. As the US utility scale solar industry faces challenges related to long-lead time for high voltage equipment, labor and EPC troubles along with interconnection and transmission delays, these could become additional risks for FTC's 2024 revenue ramp.

On the other hand, analyst Jeffrey Osborne of TD Cowen believes the management and the board have done a 'solid job in righting the ship'. FTC has improved transparency about it challenges in the past to convert awards into orders. "The backlog transparency underscores a more believable dynamic relative to one in which the company was consistently reporting backlog well over $1bn but revenue of sub-$50mn per quarter over the past few years," explained Osborne.

FTC added close to $213 million in its backlog of executed contracts and awarded orders since November 8, 2023. The total now stands at around $1.7 billion.

While the tracker maker's Q4/2023 financials were in line with its guidance, FTC has lowered the Q1/2024 guidance it announced previously. From expecting revenues of $40 million to $50 million, FTC now expects Q1 revenues to range between $10 million and $15 million.

"We expect first quarter 2024 revenue to be down from the fourth quarter and represent the trough in revenue for the year. Beyond the first quarter, we expect to see continued sequential revenue growth for the remainder of the year, with revenue being weighted toward the second half of the year. We expect to approximate breakeven on an Adjusted EBITDA basis in the third quarter and be profitable in the fourth quarter," stated the management.

Providing an update to its CEO search, FTC says it continues to look for a new CEO after Sean Hunkler left in December 2023 along with CFO Phelps Morris. The company's Chief Accounting Officer Cathy Behnen is currently working as the interim CFO.