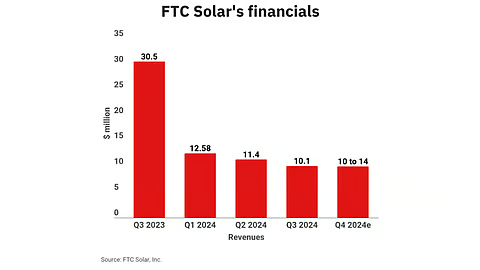

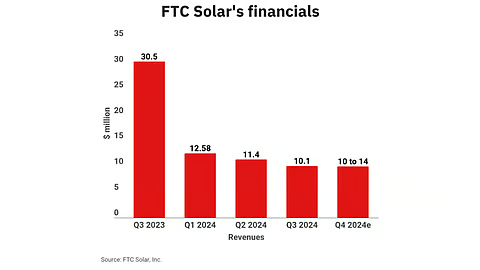

FTC Solar’s Q3 2024 financial results were in line with the guidance with revenues of $10.1 million

It continues to report losses, but the management is confident of the growth in the near future

It has secured a new institutional investor that should improve its financials

Its total contracted backlog increased to worth $513 million, driven by 1P product

US-based solar PV tracker manufacturer FTC Solar managed to achieve its GAAP revenue guidance for Q3 2024 with $10.1 million, even though it declined by 11.3% quarter-on-quarter (QoQ), and 66.8% year-on-year (YoY) owing to lower product volumes.

Due to lower revenues that were insufficient to cover certain fixed indirect costs, the management said its GAAP gross loss widened to $4.3 million or 42.5% of the revenue. In the previous quarter, the gross loss was $2.3 million, representing 20.5% of the revenues (see Project Delays Pull Down FTC Solar’s Q2 2024 Revenues By 9.2% QoQ).

GAAP net loss for the reporting quarter was $15.4 million, while the adjusted EBITDA loss also widened to $12.17 million, compared to a loss of $9.7 million in Q3 2023.

Nevertheless, analysts see the company positioned strongly in the future. Matthew Ingraham of ROTH MKM explained, “Despite this, we look forward to the company's new leadership team righting the ship. FTCI has recently closed a number of new deals totaling >2.5GW, and we expect more progress ahead. The company has a lot of work ahead, but appears to have a strong foundation with customers.”

Thomas Boyes of TD Cowen agreed when he stated, “We view the announced agreements, including the 1GW tracker supply with Dunlieh as a clear positive toward a path to profitability.” (see North America Solar PV News Snippets: SOLARCYCLE To Build 5 GW Recycling Fab & More).

Since August 8, 2024, the company has added $18 million of new purchase orders, taking its contracted backlog to $513 million. More than 70% of Q3 bookings are for its 1P product, which represented around 30% of the revenues during the reporting quarter. For the sake of comparison, 1P accounted for 16% of its revenues in Q2 2024.

The management said its transition from 2P-only to broad offering across 1P and 2P opens up about 85% of the market for the company.

FTC President and CEO Yann Brandt shared, “As I take stock of our positioning at the 90-day mark, I believe the company is in an enviable position in many respects. This includes having a product portfolio that customers love, a business they appreciate working with, and a cost structure poised to enable strong margin growth and profitability. In addition, the company now has a compelling and expanded 1P product set that opens up the vast majority of the market that wasn’t available to the company in the past.”

Additionally, FTC has secured a new institutional investor to invest $15 million, which will get the latter a seat on the company’s board.

Yet, the management continues to be cautious with its Q4 2024 outlook. It forecasts $10 million to $14 million in revenues, approximately flat to up 39% relative to the 3rd quarter, with a non-GAAP gross loss of $4.2 million to $1.5 million.

FTC expects continued improvement in revenue, margin and adjusted EBITDA for Q1 2025.

On its Q3 earnings call, Brandt reflected on the results of the US Presidential Elections 2024 to stress that solar has headwinds and tailwinds regardless of who is in the White House and who has control of Congress.

“So with the data center growth and what the utilities are saying, the base load growth rate is, the energy is going to have to come from somewhere. And solar is the easiest, fastest, cheapest choice as well as being the cleanest and has one of the largest development pipelines out there,” added Brandt.