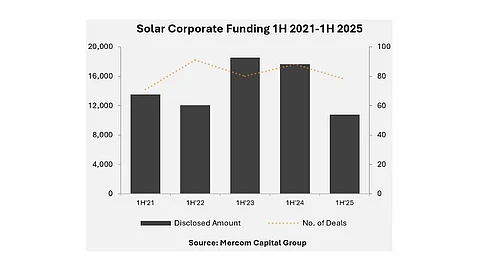

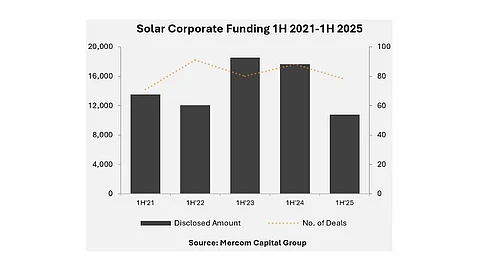

Mercom Capital Group says the total corporate funding for the solar sector fell by 39% YoY to $10.8 billion in H1 2025

While VC funding declined by 7%, public market financing dropped by 73%, and debt financing by 41%

Solar M&A transactions rose to 50 as demand for attractively valued assets remains strong

Total corporate funding in the global solar sector fell to $10.8 billion in the first half of 2025, a 39% decline year-over-year (YoY). Mercom Capital Group attributes the drop to widespread policy, trade, and market disruptions that influenced investor confidence.

In its 1H and Q2 2025 Solar Funding and M&A Report, Mercom states that the total number of deals also dropped by 11% YoY to 78.

“A wave of legislative, trade, and capital market disruptions in the first half of 2025 led to a broad reset across the solar sector, altering the industry’s trajectory with both immediate and long-term impacts,” said Mercom Capital Group CEO Raj Prabhu. “For developers, investors, and manufacturers alike, the period was defined by the need to recalibrate in real-time amid a rapidly shifting market landscape. As a result, financial activity declined sharply.”

Venture capital/private equity (VC) funding dropped 7% to $2.5 billion in 32 deals entered by 86 investors. This comprises $1.1 billion raised in Q2, representing a 50% annual decline across 18 deals.

Solar downstream companies led the financing activity, bringing in 25 deals worth $2.2 billion during H1 2025. Origis Energy’s $1 billion raise was the top VC deal during H1, followed by $500 million for Silicon Ranch, and $130 million by Terabase Energy (see SoftBank Vision Fund 2 Invests In Terabase Energy).

Public market financing of $467 million in 5 deals was 73% lower than $1.7 billion across 8 deals in H1 2024. Solar debt financing activity also declined by 41%, with 41 deals bringing in $7.8 billion (see $16.6 Billion H1 2024 Global Solar Corporate Funding).

According to the report, during H1 2025, a total of 4 securitization deals totaled $1.6 billion, representing a drop of 47% compared to $3 billion raised in 9 deals in H1 2024.

There was an uptick in solar mergers and acquisitions (M&A) transactions as the report writers count 50 such deals being realized in the initial 6 months of 2025, compared to 40 reported a year ago. The largest of such deals this year was the ONGC NTPC Green’s agreement to acquire Ayana Renewable Power for $2.3 billion (see ONGC-NTPC JV To Acquire Ayana Renewable Power For $2.3 Billion). Prabhu notes that investor demand for attractively valued solar assets remains strong.

Mercom says H1 2025 saw 106 solar project acquisitions worth 19.9 GW completed, compared to 18.5 GW in H1 2024. The most active acquirers were investment firms, picking up 2.1 GW in Q2, followed by oil and gas companies with 1.53 GW.

“Looking ahead to the second half of the year, the industry’s ability to adapt to the new policy environment and restore capital flows will determine the pace and direction of recovery,” opines Prabhu.

The complete report can be purchased from Mercom Capital Group’s website for prices starting at $299.