Ongoing challenges of high component and shipping prices are going to have lingering effects on the global solar PV industry as Rystad Energy estimates around 50 GW of utility PV capacity planned for 2022 may end up getting postponed or even cancelled.

That would be 56% of the 90 GW global utility PV capacity planned for next year and such a scenario could end up impacting demand and consumer pricing for solar power, the Norway based independent energy research firm added.

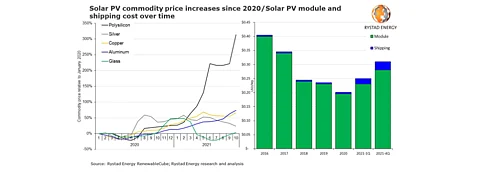

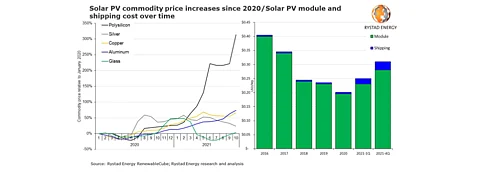

Soaring prices are already manifesting their impact, as the analysts point out, manufacturing costs have gone up to between $0.26 and $0.28 per W in H2/2021, reflecting an increase of nearly 50% from below $0.20 per W in 2020 which is mainly thanks to 300% increase in polysilicon prices. Prices of other components as silver, copper, aluminum and glass have also gone up considerably.

Shipping delays and bottlenecks, thanks to COVID-19 pandemic, have contributed to freight charges increasing close to 500% from $0.05 per W in September 2019 to $0.03 per W in October 2021.

With such dynamics at play, analysts believe it can significantly impact project economics since levelized cost of electricity (LCOE) for new projects has gone up by between 10% and 15% 'a major cost bump for most of the projects planned for 2022'.

Rystad Energy's Senior Renewables Analyst David Dixon said, "The current bottlenecks are not expected to be relieved within the next 12 months, meaning developers and offtakers will have to decide whether to reduce their margins, delay projects or increase offtake prices to get projects to financial close."

This analysis comes soon after 5 leading solar module manufacturers called on the Chinese government's attention to some of these issues facing the solar industry, while also recommending customers to defer project completion (see Chinese Solar Companies Want Action).

Interestingly, Bloomberg NEF had even increased its 2021 forecast to 191 GW in its Q3 PV Market Outlook released in September. In contrast, SolarPower Europe, in its Global Market Outlook published in July, anticipated the market to grow much slower this year, to 163 GW in 2021 due to COVID-19 and supply bottlenecks (see SPE: 163 GW Solar PV Capacity Addition Globally In 2021).