- IEA report on solar supply chains sees the industry as vulnerable to heavy dependence on China

- Countries need to diversify their solar PV supply chains in a sustainable and affordable manner, by way of policy and financial support

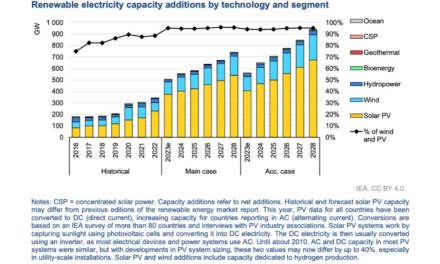

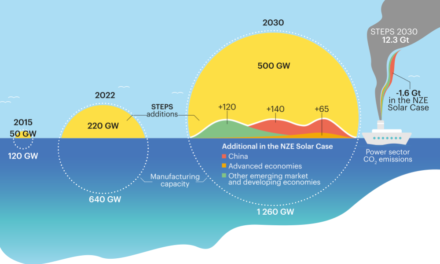

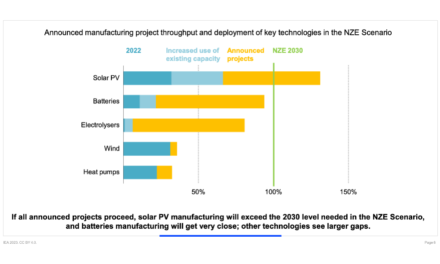

- Global manufacturing capacity of key raw materials needs to more than double by 2030 to meet net zero emissions target by 2050

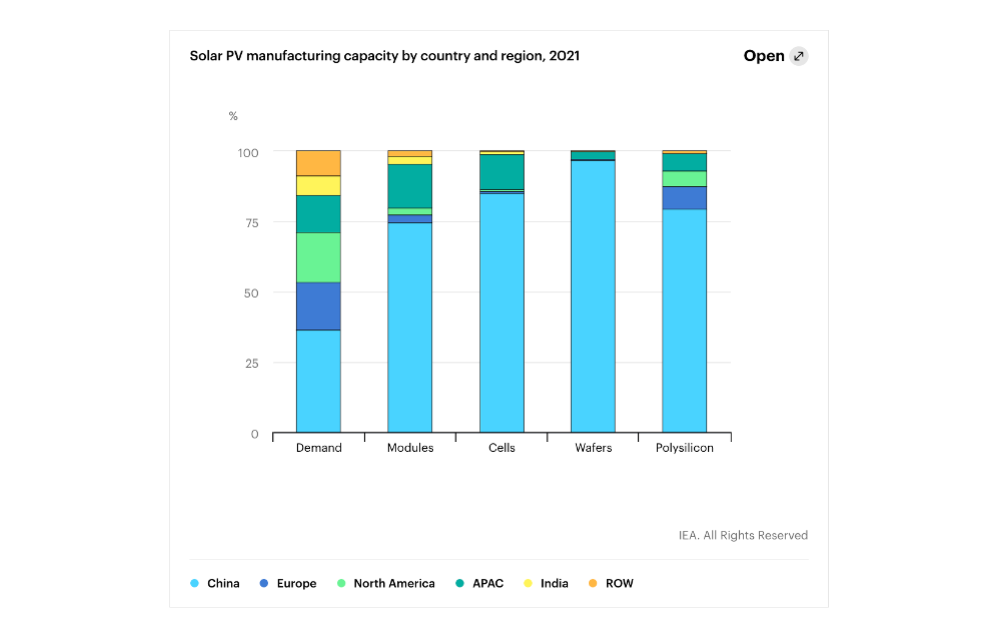

By 2025, China is likely to control 95% of global polysilicon, ingot, wafer production, up from 80% now, going by the manufacturing capacity under construction in the world’s largest PV market. For the rest of the world to avoid being this vulnerable the International Energy Agency (IEA) calls for more than doubling of a diversified integrated PV capacity.

In the IEA Special Report on Solar PV Global Supply Chains, a 1st from the agency, analysts remind that the world needs to reach 630 GW of annual solar PV capacity additions by 2030 to be on track for Net Zero Emissions by 2050, for which it needs a sustainable and secure supply chain.

“As countries accelerate their efforts to reduce emissions, they need to ensure that their transition towards a sustainable energy system is built on secure foundations. For solar PV supply chains to be able to accommodate the requirements of a net zero pathway, they will need to be scaled up in a way that ensures they are resilient, affordable and sustainable,” reads the report.

That’s also because there is a growing risk to solar’s growth with supply chain being dependent on trade policies that have increased in the last few years.

Solar PV manufacturing is an energy intensive industry, admits the IEA, but it is more so because it is heavily concentrated in China where coal power is subsidized by the government. Yet, solar power’s emission offset period is quite quick, it argues. (Source: IEA)

Addressing the concern around solar PV manufacturing being an electricity intensive process which is mostly powered by fossil fuel energy at present, the report writers argue that solar panels need to operate only 4 to 8 months to offset these emissions, and then the average panel lifetime is around 25 to 30 years.

Since manufacturing for critical solar PV ingredients is largely concentrated in Xinjiang and Jiangsu regions in China and government subsidized coal power accounts for over 75% of the annual power supply, the IEA states, “Today, coal generates over 60% of the electricity used for global solar PV manufacturing, significantly more than its share in global power generation (36%)…”.

For China, solar PV is a significant export industry as it shipped over $30 billion worth of these products in 2021 and it continues to invest in solar in Malaysia and Vietnam as well. Consider this, the total value of global PV-related trade—including polysilicon, wafers, cells and modules—exceeded $40 billion in 2022, up by 70% on annual basis.

Crediting China for helping bring down the cost of solar PV to make it the most affordable electricity generation technology globally, the IEA reasons that if the world wants to avoid the supply chain disruption situation as seen in the last 2 years that pushed up solar panel prices by around 20% in just 1 year, governments will do well to pay greater attention to facilitate local manufacturing.

New solar PV manufacturing facilities along the supply chain could attract $120 billion by 2030 and it can create 1,300 manufacturing jobs for each GW of production capacity by 2030. Nonetheless, building a diversified solar PV supply chain has its own challenges that policymakers will need to address.

Cost competitiveness is likely to pose a major challenge in diversifying and localizing PV supply chains since China sits on the top in this category. Hence, governments need to provide financial incentives and manufacturing support to improve bankability of manufacturing projects, especially for critical raw materials in solar panels.

Governments must figure out ways to provide access to comparable or lower electricity costs for polysilicon, ingot and wafer production since these consume the most electricity in the production chain. One of the ways is for these facilities to be powered by captive solar power plants on site.

Manufacturers can benefit from recycling of panels if these are systematically collected at the end of their lifetime. Supplies from recycled materials can meet over 20% of the solar PV industry’s demand for aluminum, copper, glass, silicon and almost 70% of silver between 2040 and 2050, but ‘existing PV recycling processes struggle to generate enough revenue from the recovered materials to cover the cost of the recycling process’.

The report can be downloaded for free from IEA’s website.