Mercom says India’s total solar cell and module production capacity increased to 7.6 GW and 77.2 GW as of June 30, 2024

It comprises 2 GW cell and 11.3 GW module capacity added during H1 2024

Gujarat is the state with the largest volume of PV manufacturing, followed by Tamil Nadu and Rajasthan for modules

Analysts caution that local manufacturers should not rely on exports as a growth strategy as the subject of local manufacturing gains ground globally

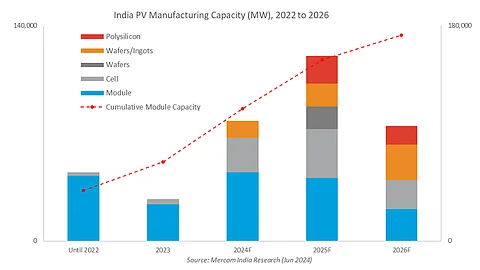

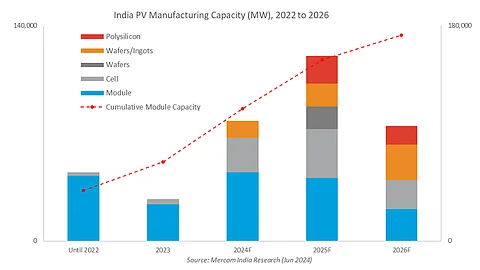

It foresees India’s module and cell capacity to grow to exceed 172 GW and 80 GW, respectively by 2026

India’s cumulative solar PV cell and module manufacturing capacity expanded in H1 2024 by 2 GW and 11.3 GW respectively, driven by a robust solar project pipeline of 132.7 GW that’s planned to come online between 2024 and 2026, says Mercom India Research in its new report.

At the end of June 2024, the country’s cumulative installed solar module manufacturing capacity reached 77.2 GW, and solar cell capacity 7.6 GW, according to the report titled State of Solar PV Manufacturing in India 1H 2024.

The push also came from the government reinstating its Approved List of Models and Manufacturers (ALMM) List I that stipulates all solar power plants, for or related to the government must use modules listed here, which are only from domestic manufacturers. According to Mercom, as of July 2024, 50.7 GW of module capacity was enlisted in the ALMM.

Now, the government is also mulling bringing in ALMM List II, which will make it mandatory to use only domestically manufactured solar cells for modules related to government projects. This should boost the country’s vertical integration in PV manufacturing (see India Invites Public Consultation On ALMM For Solar PV Cells).

At the recently concluded Renewable Energy India Expo (REI) 2024 at Greater Noida, TaiyangNews found that most module manufacturers had their eyes set on expanding into cell production anticipating ALMM List II.

According to the Mercom report, the top 10 manufacturers accounted for 58% of module and 100% of cell production capacity as of June 2024. In terms of geography, Gujarat hosts 45% of the national module production capacity and 52% of the cell facilities. It is followed by Tamil Nadu accounting for 10% and Rajasthan 8% of the national module capacity.

Gujarat is the most preferred destination for PV manufacturers since it provides strong infrastructure support such as reliable electricity and quick setup of substations. At the same time, Mercom India Managing Director Priyadarshini Sanjay said the manufacturing clusters in the state are located near major markets like Maharashtra and Rajasthan with access to ports.

After Gujarat, solar cell production is concentrated in Telangana and Himachal Pradesh as these accounted for 28% and over 10% share, respectively.

Mercom India’s Managing Director Priyadarshini Sanjay stressed the need to have long-term visibility for large-scale investments into India’s vertical integration. “Policy certainty and support for long term manufacturing, including government-aided lending programs, will be critical for investing in solar cell production. Cell manufacturers will find it challenging to justify large investments without a visible stable market for the next 5 to 10 years.”

Mercom forecasts India’s solar module manufacturing capacity to exceed 172 GW and cell capacity to reach over 80 GW by 2026. Right now, there is no further vertical integration in India, but wafer/ingot capacity is likely to start within 2024, followed by wafer and polysilicon production in 2025.

The report also mentions that various public sector and government entities issued tenders to procure 7.6 GW of modules in H1 2024. Manufacturers shipped over 3 GW of modules with exports representing an increase of over 16% year-on-year (YoY), and 148.6 MW of cells whose exports went up by more than 195% YoY.

With the ALMM List I reimposition on April 1, 2024, India imported 13.2 GW of modules during the reporting period, with more than 84% imported in Q1. JinkoSolar, LONGi Green Energy Technology, and Waaree Energies were the leading suppliers for Indian projects during H1 this year.

India continues to rely on imported cells for its module capacity as cell imports increased by nearly 152% YoY to 15.5 GW.

Sanjay believes Indian manufacturers will need to cater to the local demand as domestic demand grows rather than focus on export markets in the future. She also added that companies should be careful of relying on exports as a growth strategy since several countries are now encouraging local production.

The complete report can be purchased from Mercom’s website.