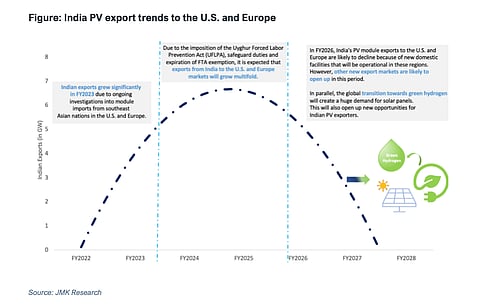

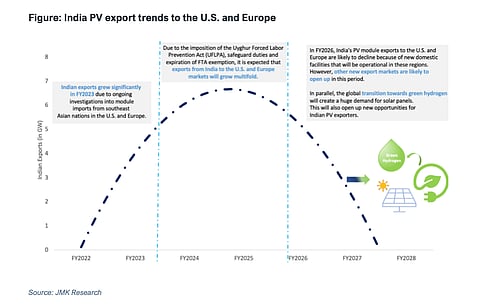

Indian solar PV module manufacturers have been increasingly exporting to the US, a trend that's likely to gain momentum till about 2025. As the Inflation Reduction Act (IRA) supported manufacturing facilities start coming online, Indian suppliers will see their exports start to decline from 2027 onwards, according to a joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

In FY 2023, Indian module exports to the US improved 16 times from FY 2022 by value as the North American nation has blocked Chinese modules from entering the country under provisions of the Uyghur Forced Labor Prevention Act (UFLPA). Trade barriers continue to haunt module supplies from Southeast Asian nations as well.

"The IRA has ushered in a substantial export opportunity for Indian companies involved in the manufacturing of upstream components. With capacities under the Production Linked Incentive (PLI-l) tranche already awarded in November 2021, Indian players have a head start of at least one year compared to companies setting up facilities in the US," reads the report.

Basis public announcements, the report writers expect the US to add 50 GW of module manufacturing capacity by 2026 backed by the IRA, while upstream component manufacturing remains challenging with their complex, expensive and energy-intensive processes.

Taking advantage of the IRA, several Indian manufacturers are also planning to set up their module production facilities in the US, while looking at India for cell or ingot/wafer lines. IEEFA's Director South Asia, Vibhuti Garg believes, "Future iterations of PLI may include layered incentives, an extended policy impact period, easier eligibility criteria to avail incentives, etc."

In fact, it is also the European Union's (EU) European Green Deal that's expected to pull down Indian exports to the region once domestic production capacity starts to come online. At present, more than 31 GW of new module manufacturing capacity has been announced in this region to come online over the next few years, according to the report.

However, for the EU, analysts believe there is still time before the authorities come out with clear outlines for production incentives and firm trade barriers are enacted.

"It will take two to three years to establish PV manufacturing capacity in the US and Europe. Till then, Indian players have a very attractive opportunity to be their PV supplier, especially in the US market, with its duty restrictions on PV imports from China," explains JMK Founder Jyoti Gulia. "But once the domestic market develops in the US and Europe, Indian players must explore other overseas export markets, including Africa, South America, etc."

Additionally, analysts expect the transition to green hydrogen creating further demand for solar PV panels, thus creating a considerable global market for PV manufacturers.

As demand continues to grow and more regions opt for 'China+1' strategy to find other procurement channels beyond China alone for their solar PV module requirements, Indian manufacturers will need to compete with other large PV manufacturing countries on quality and scale.

The process has started as most Indian manufacturers are adding new lines based on PERC upgradable to TOPCon or heterojunction (HJT) technology (see Day I Highlights From Renewable Energy India Expo 2023). Additionally, as the PV industry technology improves dynamically, they must also plan and prepare for future upgrades.

The joint report by IEEFA and JMK Research, titled New Paradigms of Global Solar Supply Chain, is available for free download.