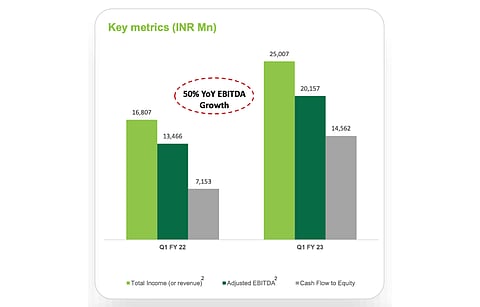

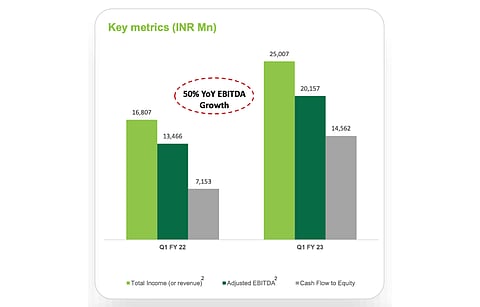

Indian renewable energy company ReNew Power grew its total income in Q1 FY23 (period ending June 2022) by 48.8% annually to INR 25 billion ($316 million) and adjusted EBITDA by 49.7% to INR 20.15 billion (255 million). But it reported a net loss of INR 104 million ($1 million) due to one-time expense for debt premium and impacts of a reclassification of a hedge loss.

In the reporting quarter, it commissioned 20 MW solar and 37 MW wind assets. As of June 30, 2022 ReNew's total portfolio expanded by 30.3% annually to comprise 12.9 GW out of which 7.6 GW is commissioned (including 3.708 GW solar), and 5.3 GW is committed.

Since then, it signed additional power purchase agreements (PPA) for around 300 MW taking its aggregate portfolio to 13.2 GW. In all, 95% of its total portfolio is contracted under PPAs.

Management shared that corporate PPAs now represent 10% of its portfolio, up from 4% a year back. It now anticipates 25% of future portfolio growth from this segment.

Guidance

For FY23 (period ending March 2023), it has guided for adjusted EBITDA to fall within the range of INR 66,000 to INR 69,000 (at current exchange rate it should be within $827 million to $864 million. The company expects 95% of EBITDA from operating assets.

Recently, the company secured $1 billion loan from a consortium of 12 international lenders for its 1.3 GW hybrid wind, solar and battery storage project to supply power on round-the-clock (RTC) basis (see India's Largest ECB Project Finance For RE Project).

Justin Clare of Roth Capital Partners opined, "We believe RNW is well-positioned to fund growth with >$800mn of cash on the balance sheet and a demonstrated ability to recycle capital from the sale of minority stakes in projects."

.png?w=50&fm=png)