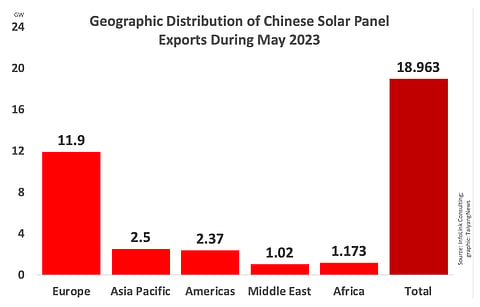

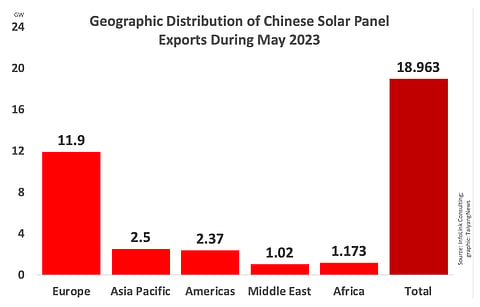

Chinese solar module exports to the rest of the world continue to grow as the country shipped 88 GW worth capacity during 5M/2023, representing 39% annual increase, comprising 18 GW in April and 19 GW in May alone, according to InfoLink Consulting.

Earlier, InfoLink had said Chinese solar panel exports in 4M/2023 rose 41% annually to 69 GW (see Chinese Solar Exports Head North).

Europe continues to be the largest customer as it secured 56% more modules annually in the initial 5 months of the year, with 51.9 GW. Of this 10.6 GW was in April and 11.9 GW in May. The latter is a 34% annual jump. InfoLink analysts believe thanks to 'massive inventory draws' earlier this year annual growth rates in the last 2 months showed signs of 'slowing down'. Nonetheless, during Q2 inventory draws increased much slower than the previous quarter.

Even electricity prices came down during the reported period, thus adversely impacting module demand.

"Since Europe is the largest overseas market, a slowdown in its inventory draws will affect manufacturers' shipment plans this year. While Europe and Brazil, the fast growers last year, gradually losing momentum, some emerging markets that used to have lower demand are experiencing higher-than-expected growth thanks to high electricity prices and module price declines," according to the analysts.

Module prices, however, have come down to $0.20/W to $0.22/W and in H2/2023 are likely to further drop to $0.17/W to $0.18/W, 'reflecting price declines across the supply chain and weakening demand in Europe'.

Asia Pacific has procured 15.2 GW capacity between January and May this year, including 2.5 GW in May that was down 19% MoM and up 17% YoY. While the Basic Customs Duty (BCD) remains in place for India, analysts believe decline in module prices can help local developers to work on their deferred projects. Demand has already started to pick as the country has bought 2 GW capacity from China during 5M/2023.

A total of 12.4 GW was purchased by the Americas in the initial 5 months, up 26% annually, and comprising 2.37 GW in May 2023. Brazil's imports declined 12.5% MoM to 1.3 GW in May as developers exhaust their inventories, along with other market factors. Chile has also procured 2 GW modules so far this year.

Led by Saudi Arabia's 536 MW in May, the Middle East imported 1.02 GW modules from China. The country continues to be on top of the list for Chinese suppliers thanks to the growth of large scale solar power projects, supported by high levels of policy enforcements. Drop in module prices is only creating more demand here. Between January and May this year, the Middle East imported a total of 4.62 GW panels from China, rising from 3.6 GW during 4M/2023.

Africa imported 1.173 GW Chinese modules, as power-crunched South Africa continues to have a growing appetite for these. Within 5M/2023, South Africa bought more than 2.6 GW Chinese panels, nearly 4.5 times more on annual basis.

InfoLink analysts forecast slower demand for Chinese panels outside China in Q3/2023 as developers work with inventory piled up in Q1/2023.