According to IRENA, utility-scale solar LCOE fell 90% since 2010 to $0.043/kWh in 2024, 41% below fossil fuels

China and India recorded below-average solar LCOEs at $0.033/kWh and $0.038/kWh, respectively

582 GW of new renewable energy installations avoided $57 billion in fossil fuel costs in 2024 alone

Geopolitics, trade tariffs, and permitting delays threaten short-term renewable cost competitiveness

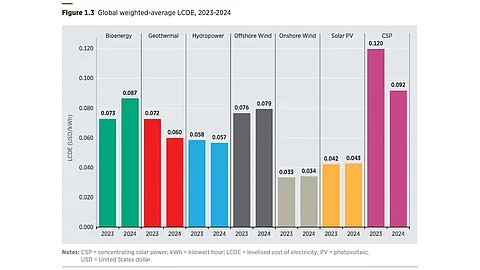

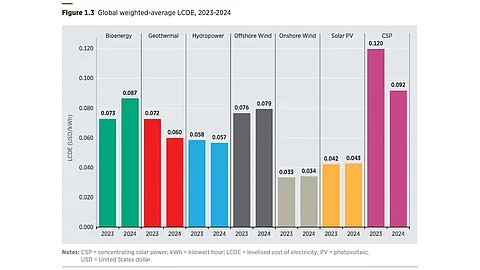

A new report from the International Renewable Energy Agency (IRENA) finds that in 2024, utility-scale solar PV generated electricity at an average levelized cost of electricity (LCOE) of $0.043/kWh – 41% lower than fossil fuels, representing a 90% decline between 2010 and 2024 from $0.417/kWh.

China and India reported below-average LCOEs of $0.033/kWh and $0.038/kWh for solar PV, respectively.

Onshore wind was the cheapest renewable source, averaging $0.034/kWh and coming in 53% below fossil fuel costs. Cost savings also came from 582 GW of new renewable power capacity installations in 2024, says IRENA, avoiding fossil fuel use worth $57 billion. Solar led installations with 452.1 GW, or 77.8% of the total, followed by wind with 114.3 GW. At the end of 2024, the total global installed renewable capacity reached 4,443 GW (see IRENA: Global Renewable Energy Additions Hit 582 GW In 2024).

Thus, renewables continued to be the most cost-competitive option for new electricity generation last year. According to IRENA, 91% of newly commissioned utility-scale capacity delivered power at a lower cost than the cheapest, newly installed fossil fuel-based alternative last year.

Grid bottlenecks and financing gaps pose growing threats, especially in developing markets. IRENA Director-General Francesco La Camera said that the avoided fossil fuel costs in 2024 reached up to $467 billion, thanks to all operational renewable energy capacity.

However, it is the remarkable decline in the cost of electricity from utility-scale solar PV that IRENA calls one of the most compelling stories in the power generation sector. Cost declines have been reported not just in modules, but also in inverters. Together, both these components were responsible for 55% of this decline since 2010, contributing to several new solar markets flourishing globally.

Over this period, module costs declined by 46% while installation/EPC/development, as well as soft costs, reported a 14% decline each, reads the IRENA report Renewable Power Generation Costs in 2024.

For solar PV, the LCOE increased slightly last year, by 0.6%, which the report writers believe reflects the changing financial conditions across markets. Between 2010 and 2024, the global weighted average capacity factor for new, utility-scale solar PV went up from 15% to 17.4%. It attributes this increase in capacity factor to evolving inverter load ratios, a shift in average market irradiance, and expanded use of trackers due to increased adoption of bifacial technologies, among others.

The total installed cost (TIC) of utility-scale PV reduced from $5,283/kW in 2010 to $691/kW in 2024, representing an 87% decline. IRENA expects further decline in numbers from here onward to $599/kW in 2025 and further down to $388/kW in 2029. Asia will retain a distinct cost advantage, but higher costs will persist in Europe and North America as these regions continue to battle the challenges of permitting delays and higher balance of system (BOS) costs.

Over the next 5 years, the global total installed costs for onshore wind are expected to reach approximately $861/kW, and $2,316/kW for offshore wind.

“Strong learning rates and high deployment sensitivity to costs – especially in Asia, Africa and South America – suggest that accelerated market growth could amplify cost reductions,” projects the report.

“New renewable power outcompetes fossil fuels on cost, offering a clear path to affordable, secure, and sustainable energy,” said IRENA Director General Francesco La Camera. “However, this progress is not guaranteed. Rising geopolitical tensions, trade tariffs, and material supply constraints threaten to slow the momentum and drive up costs.”

IRENA highlights that while long-term cost declines in renewables are expected, short-term risks from trade tariffs on renewable components and materials, as well as shifts in China’s manufacturing, could drive costs up. Financing conditions and grid integration challenges remain crucial, though hybrid systems with storage and digitalization offer improved economics and smoother integration.

A drop in battery energy storage system (BESS) costs, which has declined by 93% since 2010 to reach $192/kWh for utility-scale systems in 2024, will also be an important contributor to improving the economics of renewables.

The complete report is available for free download on IRENA’s website.