JinkoSolar has reported shipping 41.8 GW of solar modules in H1 2025, with 60% going overseas

H1 2025 revenues dropped 32.6% YoY to RMB 31.8 billion and RMB 2.91 billion net loss

The management has reiterated annual module shipment guidance and manufacturing capacity targets

JinkoSolar, one of the world’s leading solar PV manufacturers, reported shipping 41.8 GW of modules in H1 2025, with 60% going overseas, down by 2 GW on a year-on-year (YoY) basis. Despite posting losses for the period, the company maintained its annual shipment forecast at 85 GW to 100 GW.

In its unaudited results for the period, the manufacturer has not disclosed its Q2 2025 module shipment figures, having previously set a target of 20 GW to 25 GW. Given its reported module shipments of 17.5 GW in Q1 this year, the 2nd quarter shipments should be within the guided range, at 24.3 GW (see JinkoSolar Shipped 17.5 GW Solar Modules In Q1 2025).

For Q3 2025, however, it targets between 20 GW and 23 GW of module shipments. At the end of June 2025, JinkoSolar says its cumulative module shipments reached close to 350 GW.

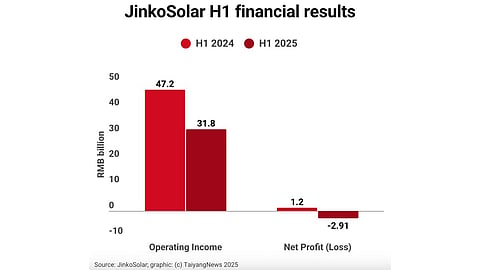

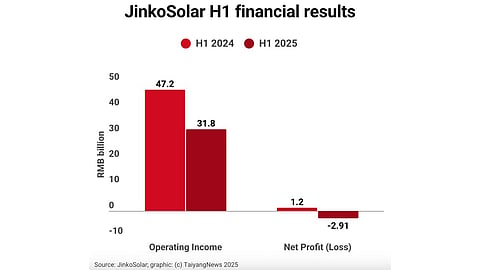

JinkoSolar’s principal operating subsidiary, Jiangxi Jinko, has reported a decline of 32.6% YoY in its operating income of RMB 31.8 billion ($4.4 billion) for H1 2025. It also suffered a net loss of RMB 2.91 billion ($406 million) – an annual decline of 342.38% compared to a net profit of RMB 1.20 billion in H1 2024.

It attributes the decline to oversupply-triggered low prices, demand fluctuations due to policy changes, and operational pressures during a period of ‘profound adjustment’ in the PV industry.

The company also lowered its R&D expenses to RMB 3.69 billion ($516 million), down from RMB 5.78 billion in H1 last year.

Nevertheless, company management says its focus during the period was on technological innovation as it secured TÜV SÜD certification for its 25.58% global module efficiency record for n-type TOPCon high-efficiency modules. JinkoSolar also reported achieving full-area conversion efficiency of 27.02% for its 182 n-type high-efficiency monocrystalline silicon cells, tested and certified by the National Photovoltaic Industry Metrology and Testing Center of China (see China Solar PV News Snippets).

The company aims to upgrade 40% to 50% of its existing production capacity to mainstream formats with a power output of 640 W or higher, by the end of 2025.

JinkoSolar continues to target annual production capacity targets of 120 GW, 95 GW, and 130 GW for mono wafer, solar cell, and solar modules by the end of 2025, respectively.