LONGi’s external sales of solar cells and modules in 9M 2025 totaled 63.43 GW, along with 38.15 GW of silicon wafers

The external sales of HPBC 2.0 back contact modules reached 14.48 GW, compared to 13.77 GW in 9M 2024

Despite the revenue decline, its 9M 2025 net loss narrowed to RMB 3.4 billion, signaling a gradual recovery

LONGi Green Energy Technology has reported cumulative external solar cell and module sales of 63.43 GW between January and September 2025. The total includes 14.48 GW of back contact (BC) modules, featuring the company’s advanced Hybrid Passivated Back Contact (HPBC) 2.0 technology.

It had earlier shipped 39.57 GW of modules during H1 2025, out of total cell and module shipments of 41.85 GW. Its silicon wafer shipments totaled 52.08 GW, including 24.72 GW sold externally. Based on these figures, its cell and module shipments for Q3 are estimated at 21.58 GW.

LONGi’s 9M 2025 module shipments represent nearly 24% year-on-year (YoY) growth over shipments of 51.23 GW in 9M 2024, which comprised 13.77 GW of BC modules. Its external sales of silicon wafers totaled 38.15 GW, compared to 35.03 GW out of a total of 82.8 GW it shipped during the same period last year.

The manufacturer attributes the growth to sustained demand for its high-efficiency product portfolio, global reach, and brand strength. It maintained a customer-centric approach while enhancing management efficiency, tightening cost control, and refining cash flow management.

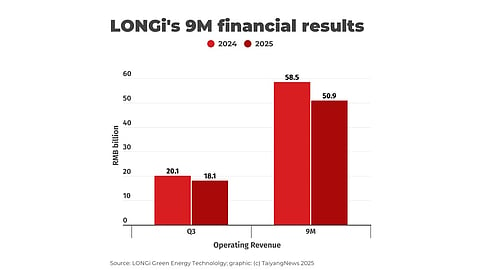

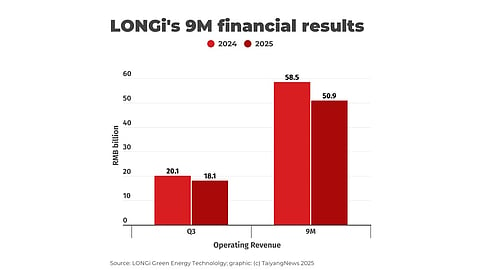

However, LONGi’s operating revenues during Q3 2025 totaled RMB 18.1 billion, representing a year-on-year (YoY) decline of 9.8% and a 5.5% quarter-on-quarter (QoQ) decline. It still reported a net loss of RMB 834 million, but narrowed it down from RMB 1.2 billion in Q3 2024.

For 9M 2025, its total revenues of RMB 50.9 billion were a decline of 13.1% compared to RMB 58.6 billion in 9M 2024. For this period, its net loss of RMB 3.4 billion was lower than the net loss of RMB 6.5 billion reported last year.

These results from one of the world’s largest solar PV manufacturers point to a recovery of the solar PV industry from overcapacity-related challenges that lowered prices to record lows in the last few quarters.

According to local media reports, LONGi management shared on its earnings call that China accounted for a 55% share of its BC sales, while overseas markets accounted for about 45%. As part of its global expansion strategy, the manufacturer plans to increase the sales of its BC products in Europe.

LONGi’s R&D Senior Manager Heng Sun will join TaiyangNews Reliable PV Module Design 2025 Conference on November 6, 2025, to share insights into the company’s HPBC 2.0 BC technology. Registrations for the virtual event are free and can be done here.