The world's largest integrated solar PV manufacturer LONGi Green Energy Technology Co, Ltd shipped 38.52 GW worth of solar modules in 2021, of which 37.24 GW accounted for external sales, representing an annual increase of 55.45%. The Chinese company is eying up to 60 GW in module shipments in 2022.

Also the world's largest wafer maker, LONGi's monocrystalline silicon wafer shipments added up to 70.01 GW out of which it sold 33.92 GW externally while the remaining 36.09 GW was used internally

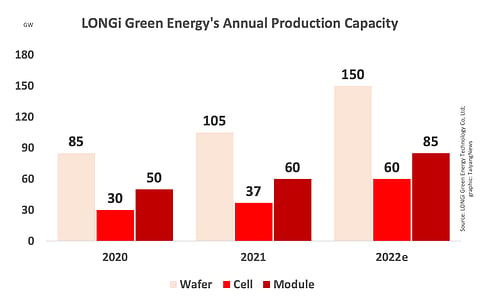

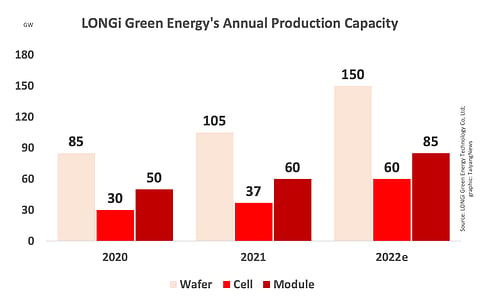

In terms of annual production capacity, LONGi said its wafer capacity reached 105 GW at the end of 2021, cell capacity 37 GW and module production capacity 60 GW. This increased from 85 GW, 30 GW and 50 GW the company reported till the end of 2020.

In terms of financials, its overall operating income went up 48.27% to RMB 80.932 billion in 2021, with overseas revenues accounting for 46.89%. The regions with largest market shares in terms of sales last year were Asia-Pacific, Europe, the Middle East and Africa, among others.

Operating costs too went up 56.98% to RMB 64.58 million. It increased R&D spending by 71.18% to RMB 854.3 million up from RMB 499.1 million in 2020.

Q1/2022

LONGi's growth momentum continued in 2022 with its annual operating income in Q1/2022 growing 17.29% to RMB 18.59 billion as net profit surged 6.46% to RMB 2.66 billion.

It shipped 18.36 GW of wafers including 8.42 GW to external clients and retaining 9.94 GW for self-use. Gross profit margin of silicon rods and wafers was 23.24%. As for solar modules, it shipped 6.44 GW including 6.35 GW sold externally.

Guidance

By the end of 2022, the company plans to further increase its annual production capacity of monocrystalline silicon wafers to a cumulative 150 GW, that of monocrystalline cells to 60 GW and monocrystalline modules to 85 GW.

Stating that it has sufficient orders in hand, and that it will strive to shorten the transit time of delivery, LONGi plans to ship between 90 GW to 100 GW of monocrystalline silicon wafers in 2022 while its module shipment target is within a range of 50 GW to 60 GW, both numbers including those for self-use.

LONGi's management expects its annual operating income in 2022 to exceed RMB 100 billion.

Referring to the consequences for the solar industry of the trade frictions between the US and China, including the recent anti-circumvention investigation launched by the US Department of Commerce, and Indian government's decision to impose Basic Customs Duty (BCD) on imported cells and modules since April 1, 2022, LONGi said such factors hinder the global advancement of carbon neutrality. The company believes it can lead to other nations to follow suit in the future.