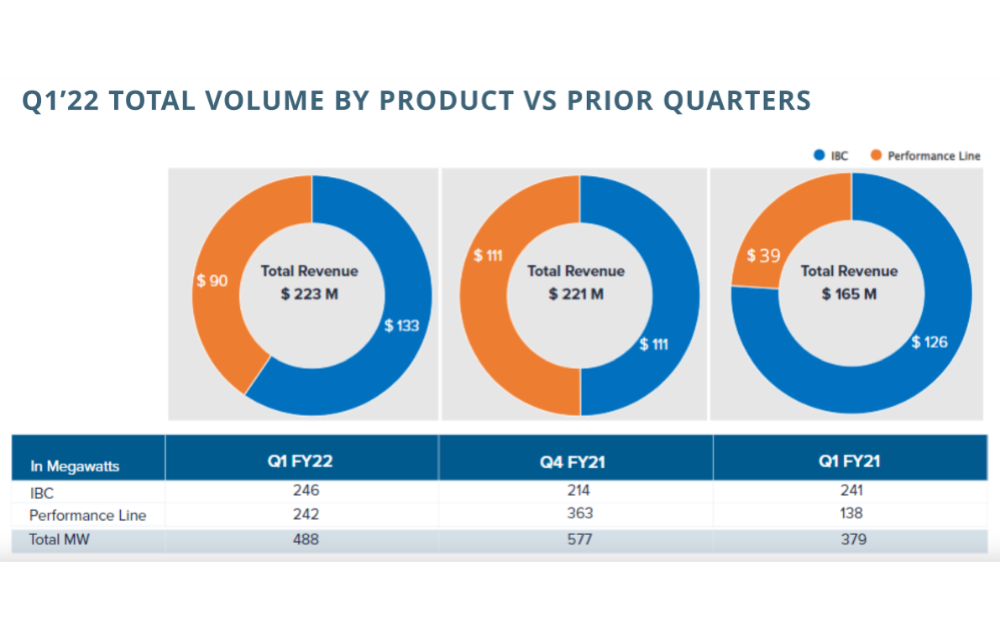

- In Q1/2022, Maxeon Solar shipped 488 MW solar modules that grew from 379 MW in Q1/2021 but declined compared to 577 MW in the previous quarter

- Its DG revenues in the EU increased 75% on annual basis and its market share in Italy has grown to more than 25%

- Management said it is focused on ramping up Maxeon 6 and Performance line for the US market as it is critical for enabling the company’s return to profitability in 2023

Singapore headquartered solar cell and module maker Maxeon Solar Technologies reported its DG revenues as having gone up by 75% in Q1/2022 along with growth in shipments, yet the company reported GAAP net loss of $-59.2 million.

In the reporting quarter, Maxeon shipped 488 MW modules, up from 379 MW in the previous year but down from 577 MW in Q4/2021, while revenues of $223.1 million improved from $165.4 million in Q1/2021 and slightly up from $221.5 million in the previous quarter (see Maxeon Solar Shipped 379 MW Solar Modules In 2021).

Its distributed generation (DG) business to the European Union (EU) was up 75% annually on ‘record volume, price increase and AC panel mix’, and Maxeon claims to have increased its market share in Italy to more than 25%.

“While supply chain conditions remain challenging, we remain focused on executing on our key transformation initiatives – specifically the ramping of our Maxeon 6 and Performance line for the US market which are critical for enabling our return to profitability in 2023,” said CEO Jeff Waters. “Maxeon 6 is scheduled to be fully ramped to 500 MW in the second half of 2022 and Performance line capacity for the US market is scheduled to be fully ramped in the first half of 2023.”

Waters also added that the company will focus on Maxeon 7 once the above projects are complete, along with ramp up of storage sales, direct US residential market entry and North America capacity expansion.

“We expect MAXN to face little risk from the most recent anti-circumvention case as the company commenced operations in SE Asia in 2010, before the original 2012 AD/CVD tariffs were enacted, and has consistently had a low percentage of inputs from China,” said Philip Shen of Roth Capital Partners.

In Q2/2022, the company guides for its shipments to range between 460 MW to 490 MW with revenues of $215 million to $230 million. Adjusted EBITDA will be in the negative with $-37 million to $-47 million.

The company is also exploring US DG market and recently announced an agreement with CED Greentech to significantly expand its residential channel program in the country touting its North American manufacturing footprint.