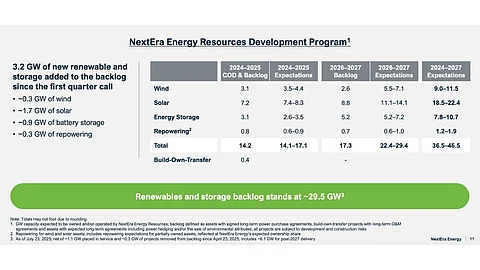

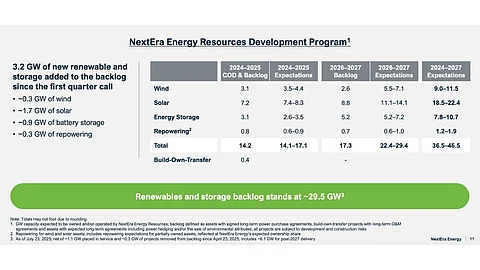

NextEra Energy Resources expanded its renewables backlog by 3.2 GW, reaching a total of 29.5 GW as of July 23, 2025

About 6 GW of the backlog is aimed at technology and data center customers, especially AI-focused hyperscalers

FPL, another NextEra Energy subsidiary, plans to add 8 GW of solar and storage by 2029 to expand its power generation portfolio

NextEra Energy (NEE), a leading US power generator, has reported a net income of $2.03 billion for Q2 2025, growing 25% year-over-year (YoY). This was driven by the continued growth in its renewable energy business under NextEra Energy Resources (NEER), despite federal policy headwinds.

NEER added 3.2 GW to its renewables backlog, exceeding the 3 GW threshold for the 6th time in 8 quarters in Q2 2025, bringing its total to 29.5 GW as of July 23, 2025. The new additions comprised solar (1.7 GW), wind (300 MW), battery storage (900 MW), and repowering for wind and solar assets (300 MW) during the quarter. It includes more than 1 GW serving hyperscalers to enable their AI buildout.

The management attributes the growth in its backlog to strong demand from technology and data center customers. In total, its backlog comprises close to 6 GW of projects intended to serve these customers.

“If you include our operating portfolio together with the expected buildout of our backlog, we will have over 10.5 gigawatts serving technology and data center customers across the United States,” said Chairman, President and CEO of NextEra Energy, John Ketchum.

It has now originated approximately 12.7 GW of new renewables and battery storage projects over the last 12 months, with roughly 30% coming from storage.

He also added that the company’s prior investments in renewables and the ‘constant state of construction’ made before the One Big Beautiful Bill Act (OBBBA) will support its project pipeline through 2029, covering both early- and late-stage developments.

OBBBA has advanced the phase-out of wind and solar tax credits under the Inflation Reduction ACT (IRA). These will only be available for projects that are placed in service by December 31, 2027, or start construction by July 4, 2026, leaving the option of safe harbor open. However, the federal government is feared to be tightening provisions around safe harbor now, leading to uncertainty among developers (see Trump Signs Executive Order To End Green Energy Subsidies).

Another NEE subsidiary, Florida Power & Light (FPL), plans to add more than 8 GW of reliable, cost-effective solar and battery storage by 2029 to complement its existing natural gas and nuclear fleet in Florida.

The management stated that FPL is America’s blueprint for utilizing all forms of energy to keep reliability high and electric bills low.

While NEE is a big name in the US renewables space, it is the smaller players that are likely to be hit the hardest under the country’s policy scenario. Nevertheless, demand for renewables seems to be growing, irrespective of the regulatory environment.

Speaking to analysts on the company’s earnings call, President and CEO of NextEra Energy Resources Brian Bolster said, “And I just want to remind everyone while the tax laws may be changing, the demand picks that we've been talking about now going on four or five quarters is not. The customer dialogue, whether it's in '27, '28, '29, or '30, is as robust as it's ever been.”